How satellite data revolutionises risk assessment in the insurance market

The insurance industry is undergoing a profound transformation driven by satellite data and advanced analytics. This offers greater potential to enhance risk assessment and claims management.

Mentioned technologies deliver unparalleled accuracy and efficiency, transforming how insurers perceive and address risk. However, alongside these opportunities come important ethical considerations that cannot be overlooked. As insurers integrate vast amounts of data into their decision-making processes, questions of privacy, transparency, and fairness rise to the forefront.

In this article, we will explore how satellite data is enabling companies to transition from a reactive to a predictive approach to risk management. We will also highlight how insurers can leverage geospatial intelligence to improve accuracy and speed, build customer trust, and embrace this new opportunity.

Satellite data capabilities transforming insurance

The transformative impact of satellite data on the insurance sector stems from its diverse technological capabilities, which enable insurers to gain unprecedented insights into risk, asset conditions and environmental changes. This data is collected using a variety of sensing technologies, each of which offers a distinct advantage, including:

- High-resolution optical imagery – Satellites capture detailed images of the Earth’s surface that are useful for identifying property conditions, infrastructure changes and post-event damage. These images provide great visual clarity. This imagery enables accurate underwriting and rapid claims validation without the need for physical site visits.

- Multispectral & hyperspectral data – By capturing data across different wavelengths, these sensors provide information that is invisible to the human eye, such as the health of vegetation, the moisture content of the soil, and the composition of materials. This data is invaluable for crop insurance, as it enables the monitoring of agricultural health and the early detection of droughts, pest infestations or disease outbreaks.

- Synthetic Aperture Radar (SAR) – Unlike optical sensors, SAR can penetrate clouds and operate day or night, making it indispensable for monitoring flood extents, land subsidence and infrastructure integrity in all weather conditions. This improves the accuracy of risk assessments, especially in challenging climates and disaster scenarios.

Check out our geospatial offerings!

Read moreThe scalability and temporal resolution of satellite data allow insurers to monitor risks continuously on a global scale, providing historical context alongside near-real-time updates. This capacity enables dynamic risk modelling that reflects changing environmental conditions, rather than relying solely on static or historical data. Furthermore, integrating satellite data with artificial intelligence, machine learning and cloud computing platforms enhances the extraction of actionable insights through automated feature detection and predictive analytics. Consequently, insurance companies can:

- Track the progression of natural disasters, such as wildfires or hurricanes, and trigger proactive claims management and policyholder communication.

- Detect subtle changes in property or environmental conditions that indicate emerging risks.

- Improve portfolio exposure analysis with geo-specific, frequently updated risk maps that account for climate variability.

Combining multiple satellite data types and sources enables insurers to gain a comprehensive, multi-dimensional view of risk, empowering more accurate underwriting, fraud detection and claims processing. This reduces operational costs and increases customer satisfaction. This development establishes satellite data as a vital enabler of the transition to more predictive, data-driven insurance models that can respond swiftly and effectively to an increasingly complex risk scenario.

How to revolutionise risk assessment processes with satellite data?

Traditionally, insurance risk assessment has relied heavily on retrospective analysis, using historical claims records, actuarial tables and static environmental data. While this approach is effective to a certain extent, it often fails to capture the dynamic and evolving nature of modern risk, particularly in the context of climate change, urban sprawl and increasingly frequent natural disasters. Satellite data is transforming this paradigm by enabling insurers to shift from reactive practices, responding after a loss occurs, to predictive and preventative strategies that anticipate risk before it materialises.

Key advantages of satellite-driven risk assessment

Near-real-time disaster monitoring

Satellites can track catastrophic events such as hurricanes, wildfires and floods as they unfold. This enables insurers to warn policyholders, trigger contingency plans and provide faster support with claims.

Early detection of emerging risks

Subtle changes in the environment or infrastructure can be identified before they result in significant losses. For instance, Synthetic Aperture Radar (SAR) can reveal the initial stages of subsidence, while multispectral imaging can highlight vegetation stress caused by drought or pest infestations.

Dynamic portfolio risk modelling

Near-real-time satellite observations feed into geospatial risk maps that reflect current conditions rather than historical averages. This allows insurers to assess exposure more precisely, develop granular underwriting strategies and allocate reinsurance capital more effectively.

These capabilities mark a decisive shift towards a predictive, data-driven insurance ecosystem. Companies that make use of satellite intelligence are better placed to reduce losses, streamline operations and strengthen policyholder trust by providing faster, fairer and more transparent services.

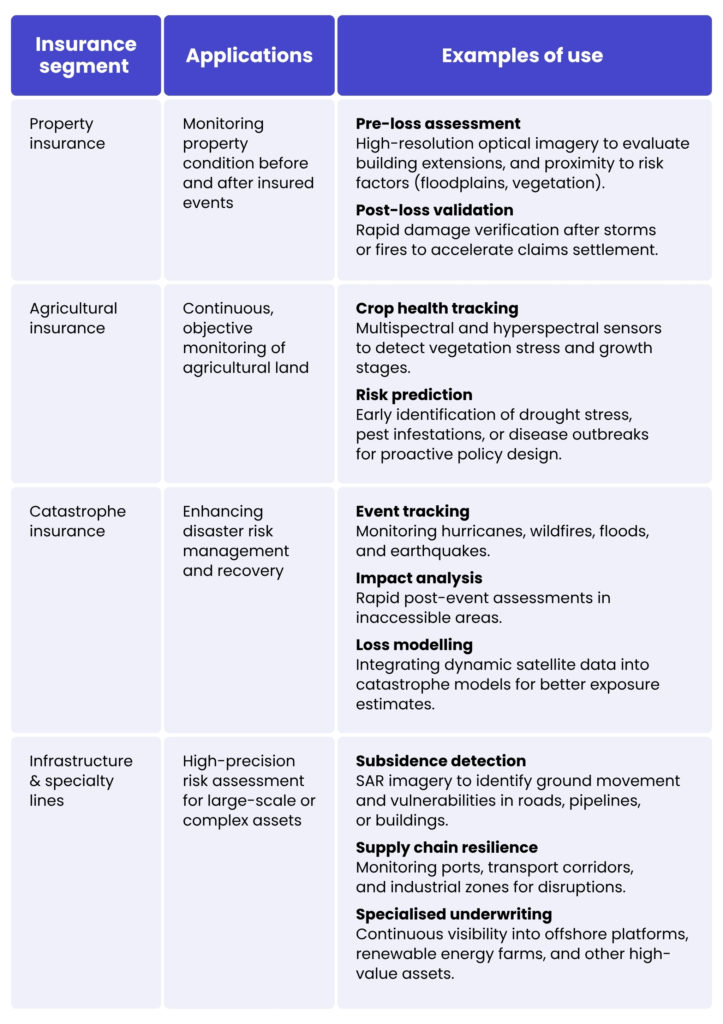

Applications across insurance segments

The versatility of satellite data means that it can be used to great effect in virtually every area of insurance. Satellites provide timely, reliable and independent information, empowering insurers to tailor risk assessment and claims processes to the unique demands of each market segment.

Satellite data is a practical and scalable solution that can transform core processes. Integrating geospatial intelligence into underwriting, claims handling and portfolio management enables insurers to evaluate investments more accurately, assess losses more quickly and respond to evolving risks.

In agriculture, for example, insurers can use satellite data to monitor crop health and assess damage, enabling them to underwrite crop insurance more precisely. In the property and casualty sector, high-resolution imagery enables rapid roof damage assessments after storms and ongoing property condition monitoring, thereby improving underwriting accuracy and claims efficiency. In the marine and logistics sectors, satellite intelligence enables near-real-time tracking of shipping routes, helping insurers to detect potential risks and manage exposure proactively.

In a market where speed, precision and customer trust are crucial, the capabilities of today’s satellites represent a true game changer, giving insurance companies that embrace them a competitive advantage.

The business benefits of satellite technology for insurers

Increased accuracy in underwriting

Leveraging high-resolution imagery, multispectral data and real-time environmental monitoring enables insurers to evaluate properties, crops and infrastructure with unparalleled precision. This results in more reliable risk assessments, better pricing decisions, and reduced exposure to unexpected losses.

Faster & more efficient claims validation

Satellite data enables insurers to verify claims remotely, eliminating the need for time-consuming site visits. Rapid post-event assessments enable faster payouts, improving customer satisfaction and helping to maintain trust during critical moments.

Reduced fraud through independent data verification

Objective geospatial intelligence enables insurers to corroborate policyholder claims and detect inconsistencies that may indicate fraudulent activity. This improves risk management while ensuring fairness for legitimate policyholders.

Lower operational costs & improved customer trust

Automating risk monitoring and claims validation reduces administrative overheads and resource-intensive processes. At the same time, policyholders benefit from a faster service and more transparent decision-making processes, which fosters loyalty and confidence in the capabilities of the insurer.

Competitive differentiation in a data-driven market

Companies that adopt satellite-enabled analytics can gain a strategic advantage by offering more accurate pricing, proactive risk management and efficient claims processing. In an increasingly data-driven sector, this innovative ability can set a company apart from its competitors.

Wrapping up

By leveraging custom solutions, insurers gain a strategic partner rather than merely a data provider. A tailored geospatial platform can be configured to address specific business challenges, such as predicting losses, enhancing claims validation and optimising portfolio risk.

In the insurance market, satellite data is a valuable asset. Those that embrace it can achieve faster and more accurate risk assessment, streamline operations, enhance customer trust and secure a decisive competitive advantage. Those insurers ready to harness these capabilities are well-positioned to succeed in an increasingly complex, data-driven landscape.

If you’re looking to take your data analysis to the next level, our experts are here to help. Contact our team to find out how we can support your organisation in making the most of satellite data.

Satellite data provides insurers with high-resolution imagery and geospatial insights, allowing for precise evaluation of properties, crops, and infrastructure. It enables near-real-time monitoring of environmental changes and natural disasters. This shift from historical to predictive data enhances underwriting accuracy and proactive risk management.

Insurers use high-resolution optical imagery for property assessment, multispectral and hyperspectral sensors for agricultural monitoring, and Synthetic Aperture Radar (SAR) for all-weather infrastructure observation. Each technology provides unique insights that support underwriting, claims validation, and disaster response.

Remote monitoring enables insurers to verify damages without sending adjusters on-site. Rapid post-event assessments allow for faster payouts and improved customer satisfaction. It also supports early detection of emerging risks, preventing larger losses.

Yes. Independent geospatial intelligence allows insurers to cross-check policyholder claims against objective evidence. This reduces fraudulent claims while ensuring fair treatment for legitimate customers.

Property, agricultural, catastrophe, and specialty lines all gain significant advantages. Satellites help monitor assets, track disasters, assess crop health, and manage complex infrastructure risks. Ultimately, these capabilities improve accuracy, efficiency, and customer trust across the industry.

About the author

contact us

Let’s get in touch to check how our experts could support your project

our blog