commodity link

Unlock efficiency by automating your commodity trading

Meet Commodity Link – our proven concept for automating and standardising order processes, bringing clarity to the chaos.

Are unstructured processes draining your time and resources?

System delays, manual steps and inefficiencies can hit your margins, increase risk, and slow down performance. Here are some of the challenges we can help you tackle:

Manual work raises operational risk

Outdated processes depend on manual tasks and fragmented communication – slowing workflows and increasing error rates.

Errors drain time and trust

Manual data entry and disconnected tools lead to avoidable mistakes that are slow to fix.

Lack of visibility delays decisions

Without real-time tracking, it’s hard to act quickly or align trades with market fluctuations.

Systems can’t cope with volume

High loads during market shifts often cause execution delays, missed trades, and added cost.

Poor timing eats into margins

Processing lags force trades at the wrong time, reducing profits and increasing risk.

Legacy systems slow progress

Older infrastructure is hard to integrate, harder to scale – and a barrier to efficiency and growth.

Bring structure and speed to your commodity trading

Commodity Link is a flexible, custom-built solution designed specifically for commodity trading. It’s not a rigid SaaS platform – it’s a proven concept built on our deep expertise, optimising and automating your unique processes in a way that’s tailored to your needs.

Structured order management with full trade context

The solution supports advanced order packages like One-Cancel-Other and time-linked trades, capturing details such as timestamps, pricing rules, execution strategies, and instruments. Ready-made templates for common order types streamline recurring workflows, and orders can be auto-generated from contracts.

Flexible editing with built-in control and traceability

The platform allows quick edits for non-critical changes and approval-based editing for execution-sensitive fields. Traders can approve or reject changes with full traceability. Users can also cancel unexecuted portions of partially filled orders.

Dedicated client and trader modules with end-to-end oversight

Clients manage orders and view execution history, trader comments and statuses. They can also clone previous packages. Traders use a centralised module with full execution visibility, priority inbox, batch selection, and tools to prepare or aggregate trades – especially when fulfilling exchange minimums.

Real-time execution monitoring and broker platform integration

Our solution integrates with broker platforms at three levels: manual, read-only, or full read/write. Traders can stage orders for execution, monitor partial fills in real-time, and use scheduled tasks to check status conditions and push updates.

Automated OTC price generation with full scheduling and validation

Using client-defined formulas and real-time input data, our solution calculates OTC product prices on a schedule. Prices are stored and validated against pre-set rules before publication. The engine supports multiple similar products simultaneously and is highly configurable for new listings.

Smart notification engine for internal and external comms

The platform sends real-time alerts for orders, modifications, execution changes, and errors via in-app updates, emails, and Microsoft Teams. Notifications dynamically update interfaces without reloads, and emails follow configurable templates.

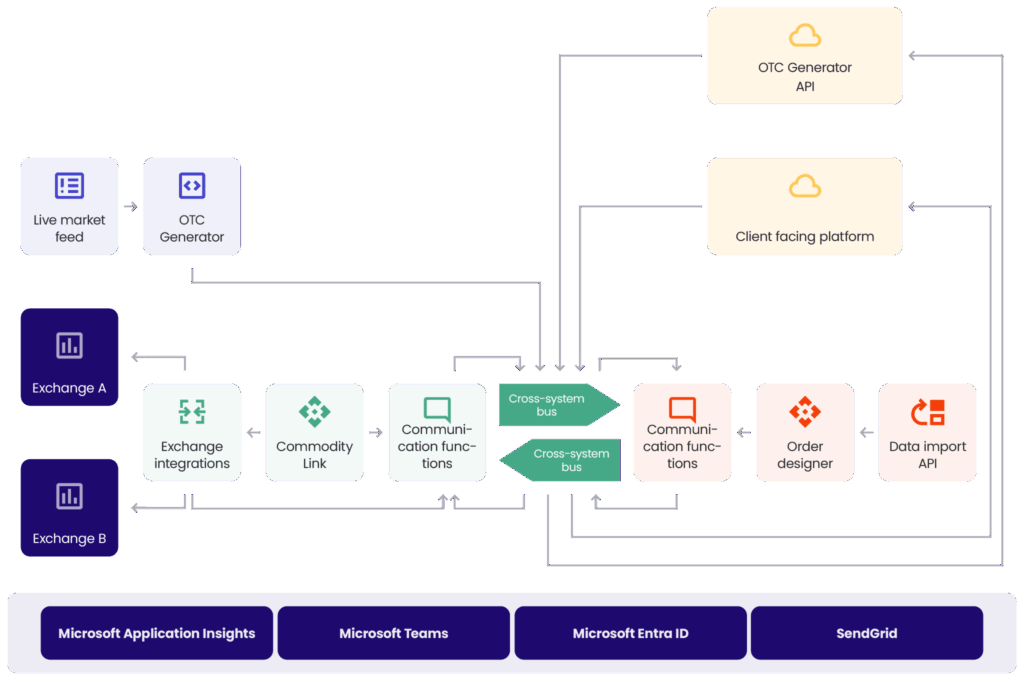

How it works

From order to execution: a simplified flow

Order creation

A client or internal team member creates a comprehensive order package with all the necessary details.

Order review

The order is sent to the trading module, allowing traders to easily review and approve it.

Execution

Once approved, the trader executes the order, with the system automatically syncing data to the broker’s platform.

Real-time updates

Status updates and execution details are tracked and communicated to all relevant parties in real-time, keeping everyone in the loop.

Measurable impact – a case study in efficiency

A REAL IMPACT

What it means for your business

Faster execution = better market timing

Increased throughput, fewer errors

One source of truth across the business

Contact us

Transform your trading operations

Ready to standardise your processes, reduce errors, and speed up order execution? Let’s discuss how we can meet your unique needs.