DebtPro

Make your Debt Management processes more efficient

A fully customisable customer self-service extension to your current system or bespoke Debt Management software – we’ll help you implement the best match to your needs.

Recover more and cut down costs thanks to our custom-made Debt Management software

Debt Management software is a real game-changer in overcoming the biggest pain points in the debt collection process. It helps reduce operational costs and ensures a better customer experience by optimising the workflows and enabling customers to repay their liabilities, adjust their repayment schedule or sign the documents online.

As experts in the financial sector, we understand the challenges our customers in the Debt Management sector struggle with. Our answer is to adjust your current solution to a digital, customer self-service era, using cutting-edge technologies, which will increase your debt collection rate.

Depending on your needs, you can extend your system with our ready-made, fully customisable customer self-service Debt Management platform that can be integrated with your existing solution or have us create a dedicated end-to-end system from scratch.

About DebtPro

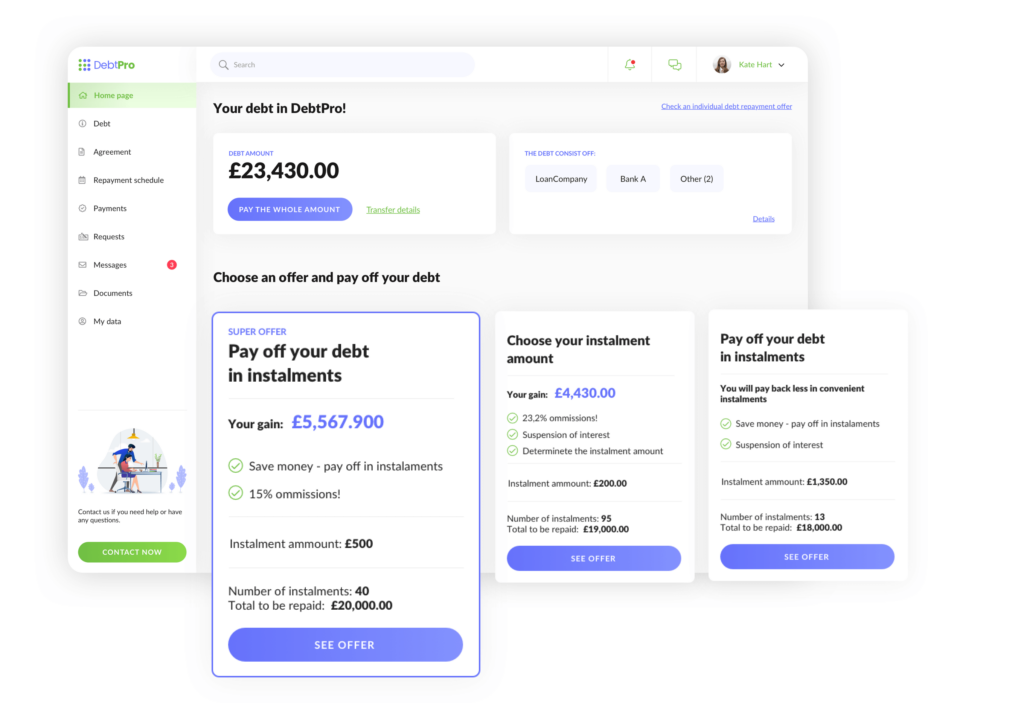

DebtPro is a unique tool that can be smoothly integrated with your current system, extending its functionality with customer self-service features. It’s fully customisable in terms of functionalities and design. It can be tailored to your company’s branding and adjusted to your specific business needs.

With DebtPro, your customers can contact you 24/7, access and manage all their debts, make payments, and sign agreements and documents online on a user-friendly dashboard.

ALL IN ONE PLACE

Improve your Debt Management process with DebtPro

A higher number of signed agreements

DebtPro allows debtors to enter into an agreement with your company online. Our clients have noticed an increase of about 10% in signed agreements and 20% in profit in a few months from implementation.

Low operating costs

Running call centres is a significant expense in a financial company’s budget. Since DebtPro allows your customers to contact you via email or chat, you can reduce the number of call centre agents and lower your operational costs.

Online access to documents

Customers don’t have to visit your company’s high street branch to sign the documents, accept or modify the agreement and adjust the repayment schedule. They can do it from the comfort of their homes, 24/7, on web browsers and mobile devices.

Suitable to service individual customers as well as businesses

DebtPro can be used both in B2C and B2B contexts as it combines the functionalities dedicated to the creditor as well as the debtor.

DebtPro doesn’t require the use of open banking services

Your company doesn’t use online banking services? No problem. DebtPro allows your customers to manage their instalment schedule and make payments online.

Fully customisable in terms of features and branding

Our team can adjust the tool to your specific business requirements and add any features you need. The design can be prepared according to your brand guidelines.

The flow of the debt collection process

Initialising

- Integration with the repayment accounts through bank API to

- Importing claim models

- Building AI/ML model from live data

- Selecting the claim model

Debt collection strategy

- Collecting data

- Establishing initial debt collection flows

- Assigning the claims to specific processes

- Evaluating the payment schedule

- Debtor sentiment analysis (optional)

- Optimising the debt collection paths (optional)

- Building prediction models (optional)

- Integration with a call centre (optional)

Reporting & monitoring

- Debt repayment monitoring

- Calculating the debt recovery rate

- Creating an automated accounting report

- Assessing strategy profitability (optional)

- Generating IT reports (optional)

Managing documents

- Attaching and archiving scanned documents

- Document OCR

- Built-in outgoing document templates (optional)

- Automated document sending

- Advanced document workflows (optional)

Bespoke Debt Management software

Difficulty in reaching debtors, data stored across multiple systems, handling repetitive tasks manually, high operational costs – do you also struggle with these common debt collection challenges?

The main reason for these issues is the lack of easy access to the necessary, up-to-date information on debtors in one place and not using the potential of advanced analytics and automation.

A dedicated Debt Management software will make your workflow smoother and more cost-effective as well as improve your customer service thanks to a customer self-service and online communication module.

Frequently Asked Questions

Thanks to the pre-built platform, and our team of experts, we can start your project right away. Rapid development means 50% less time spent implementing the project.

We can adjust the cooperation model to your needs. We will take care of everything from the choice of technology to maintenance.

We take care of all legal aspects along with the project security.

We have vast experience in the financial sector, we understand the sector well and have already successfully implemented such products for our clients in Poland.

We will provide you with all the details about the price of the final product so there are no hidden costs.

ABOUT SPYROSOFT

Who we are

Spyrosoft consists of a team of well-versed specialists passionate about the financial industry and supporting our customers from this sector. We gained 15+ years of experience and honed our software development skills working on multiple projects worldwide.

Our dedication and enthusiasm led us to be listed among Europe’s fastest-growing technology companies in 2021, 2022, and 2023, according to Financial Times.

Now, we want to share our unique product with you and your team, aimed at supporting your business in taking your customer support and automation flow to the next level.

Latest articles

Book your no-obligation demonstration

Our team will be happy to walk you through the tool and undertake a deep dive of your requirements so we can understand how to address them throughout the development process.