The top 5 risks and opportunities with AI chatbots in banking

The financial sector has witnessed a surge in the adoption of AI-powered chatbots. These intelligent virtual assistants are streamlining processes, changing customer interaction and banking services. The CFPB has released a report on integrating chatbots into financial institutions. The report shows more than 110.9 million users are expected to interact with a bank’s chatbot by 2026. Amidst the banking industry’s cautious optimism about the potential benefits of chatbots, there is an urgent need to examine the risks and opportunities involved.

This article addresses the top five risks and opportunities associated with AI-powered chatbots in banking. By exploring the potential benefits and pitfalls, we provide an overview of this technology, equipping you with the knowledge to make informed decisions as a banking professional.

What is the real potential of conversational AI in banking?

Conversational AI in banking opens the door to 24/7 customer service, personalised assistance and streamlined transactions. Customers can effortlessly check their balances, transfer funds or even apply for loans using simple conversational commands. AI-powered chatbots can leverage LLM engines and create this conversational experience by personalising interaction, initiating actions, and improving the banking experience.

Financial institutions are under pressure to improve the efficiency of their customer service. Our voicebot solution addresses this need by using artificial intelligence to automate common queries and standard tasks. This frees up human advisors to deal with more complex customer issues. To see the effectiveness of our voicebot in optimising operations for a Polish bank, take a look at our full case study!

The integration of AI is not just a technological upgrade, but a strategic imperative in the financial sector. Its role extends beyond automating tasks; it’s about enhancing operational efficiency. Financial institutions are now leveraging AI to refine decision-making processes and optimise client services. This shift is less about replacing human roles and more about augmenting human capabilities, allowing them to focus on strategic initiatives and client engagement.

Tomasz Smolarczyk, Head of Artificial Intelligence

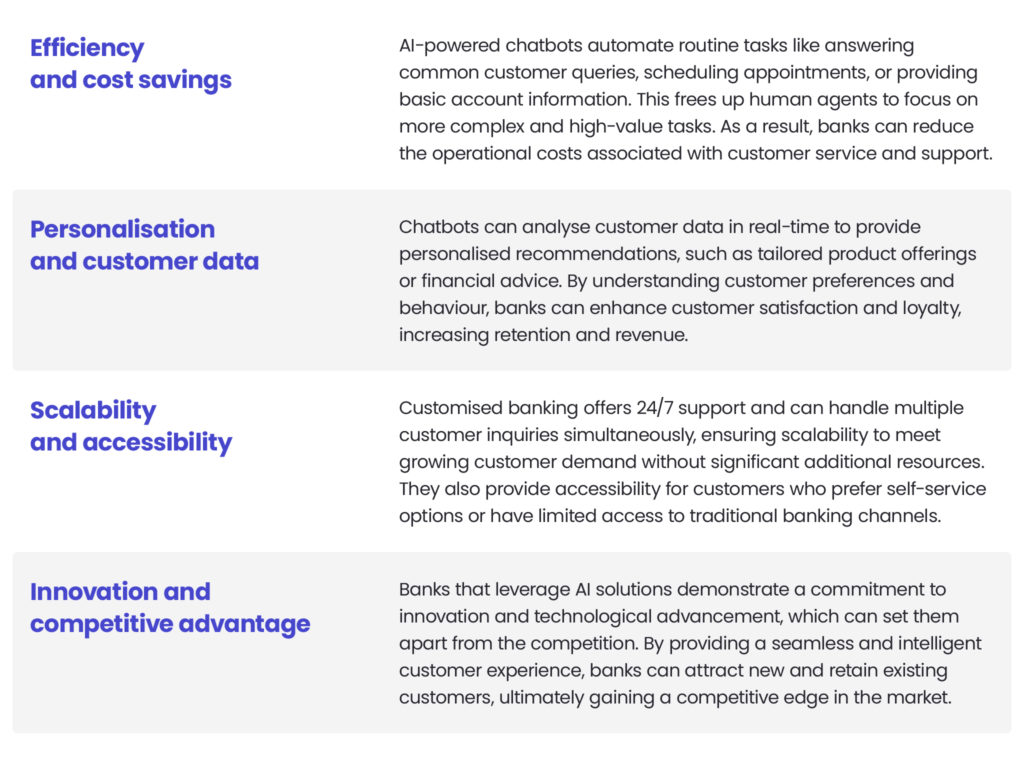

The benefits of customised chatbots for banks

Banks struggle daily with digital transformation and changing consumer expectations, so they turn to innovative solutions to improve their service offerings. By leveraging emerging technologies such as artificial intelligence, machine learning, or natural language processing, banks can tailor chatbots to their customers’ unique needs.

Financial institutions are increasingly turning to chatbots and virtual assistants, although many of these solutions are relatively older models based on rigid scenarios and often direct customers to live consultants. However, ING stands out as an interesting example, as in partnership with McKinsey, it transformed its virtual assistant, leveraging advanced GenAI technology. This allows the bank to provide customers with immediate, personalised assistance while maintaining high-security standards. Their innovative approach is based on a multi-stage process of generating the best responses, using data from various sources and evaluating them for usefulness. If multiple options arise, the system suggests diverse solutions to the customer.

These enhancements enable faster and more scalable problem-solving, as confirmed by tests conducted on ING customers in the Netherlands, which showed that the new chatbot handled 20% more customers than its predecessor.

Do you need help implementing AI in finance?

Let's talk!Understanding potential risks and considerations

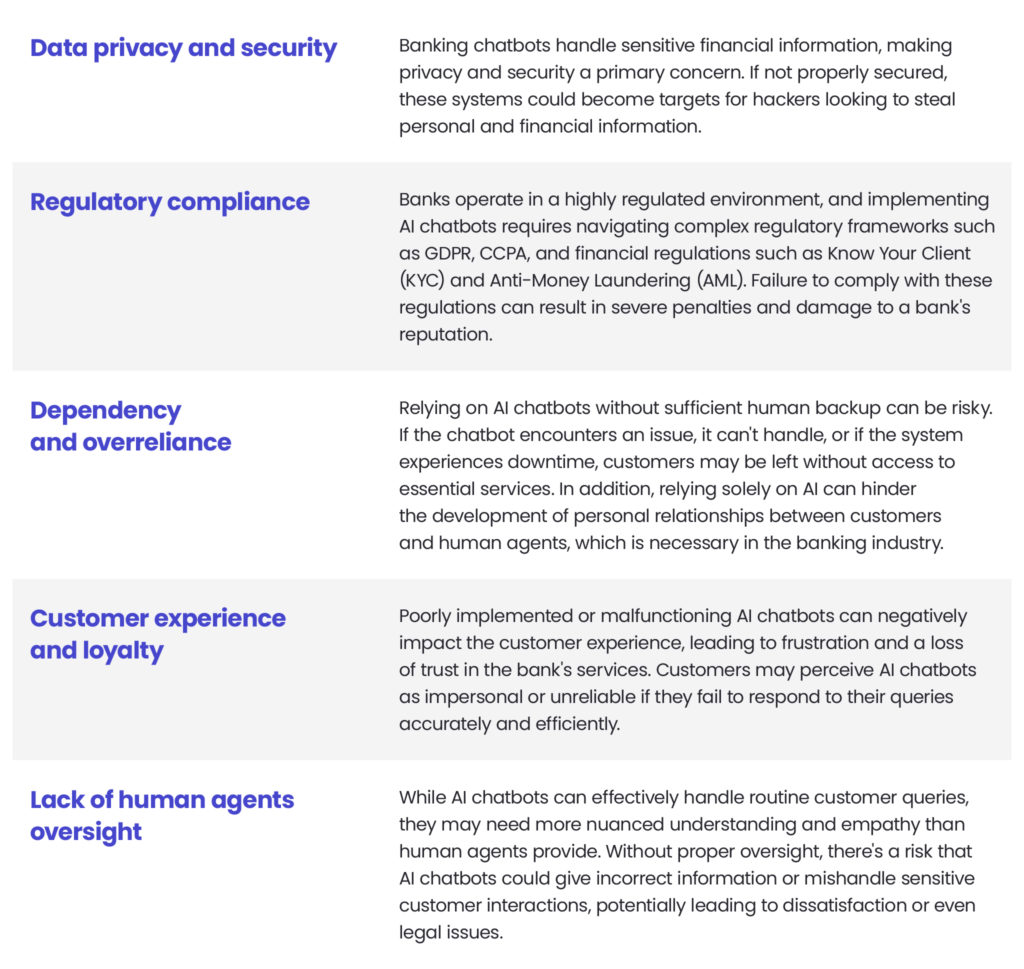

As banks decide to implement AI-driven solutions to upgrade customer interactions and streamline operations, it is crucial to be aware of the potential risks and considerations associated with this approach. While the benefits of integrating chatbots are vast, ranging from improved efficiency to enhanced customer insights, overlooking the possible pitfalls can undermine the effectiveness of these systems and compromise trust.

Now it’s time to look at the considerations banks must address when deploying bespoke chatbots, ranging from privacy concerns, regulatory compliance, algorithmic bias and human oversight. By understanding and proactively addressing these challenges, financial institutions can support the potential of chatbot technology while mitigating its associated risks.

An example of the lack of oversight of human agents can be seen in the case of Air Canada, where a chatbot misled a passenger, resulting in a lawsuit. The court disagreed despite the airline’s defence that the chatbot was a separate legal entity responsible for its actions. Air Canada must now compensate the passenger for providing incorrect information about a discount on a ticket. This incident highlights the need for companies to ensure accountability for all information provided through their platforms, whether it comes from static web pages or chatbots.

We are your partner in building custom AI chatbots

With our technical development expertise and understanding of the unique needs of the banking industry, we will create a chatbot that is perfectly tailored to your needs.

Learn more about our technology consulting services for financial institutions.

For a comprehensive overview at implementing voice solutions in banking operations, read our articles AI voicebots in the Polish banking sector (part 1) and AI voicebots in the Polish banking sector (part 2). Take the next step in transforming your customer engagement strategies and ensuring a seamless banking experience!

About the author

Contact us

Contact me to discuss how we can help you

Our blog