Omnichannel banking: 4 ways Gen AI shifts the financial industry

As the demands of banks and financial institutions’s customers grow, so does the role of technology in implementing solutions that facilitate the smooth navigation of banking services.

The emergence of generative AI in banking is driving many changes in the way financial institutions engage with clients and manage operations. Let’s take a look at the impact of Gen AI on omnichannel banking, zooming into the ways in which it’s changing industry dynamics.

Omnichannel is back and more available than ever

Omnichannel banking is a holistic approach that integrates multiple channels, such as branches, online banking, mobile applications, and call centres. It enables customers to switch between online, mobile, and in-person channels. Omnichannel retail banking also refers to the integration of these channels to provide customers with a consistent and personalised shopping experience across multiple touchpoints.

Nowadays, people expect seamless digital experiences in all aspects of their lives, especially generation Z, and banking is no exception. However, only 34% of mobile customers and 44% of online consumers found their online banking services easy to use.

Omnichannel banking will become a strategic need in order to gain a competitive edge by reaching customers where they are, anytime and whenever they require banking services. The statistics speak for themselves, a staggering 80% of banking customers insist on a seamless omnichannel experience.

As a bank user, you naturally assume that your bank is aware of the information you provide. Banks shouldn’t call you with loan offers if you have just opened a fixed deposit.

This highlights the critical need for banks to adopt an integrated and responsive approach to meet their customers’ evolving expectations.

Trends in 2024 created by AI

Artificial intelligence offers a range of opportunities in omnichannel banking, transforming the way financial institutions interact with customers and manage their operations.

Superhuman assisted by AI

Artificial intelligence enables financial institutions and bankers to become superhuman by combining their skills with intelligent tools. AI-powered systems can provide real-time insights, automate repetitive tasks, and assist in the decision-making process. For instance, AI can support bankers in analysing customer data helping bank agent to provide recommendations. At the same time, fraud detection is improving security measures.

Customer support automation

AI-powered chatbots and virtual assistants are revolutionising customer support in omnichannel banking. These systems are available 24/7 to respond immediately to customer queries, answer frequently asked questions and guide users through various banking processes such as account management, transaction history checks or loan applications. Banks are expanding bots’ capabilities, so often something that has started with basic intent recognition is turning into a much larger system.

Content personalisation

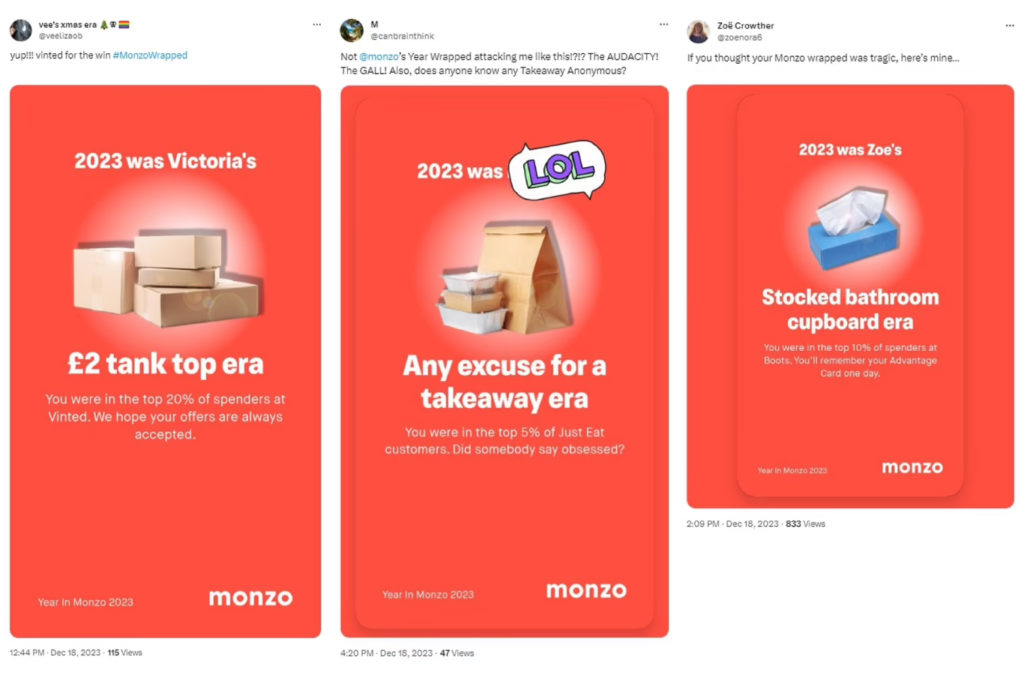

Analysing individual data has long been a compliance and ethical challenge, but gradually, banks are figuring out how to do that correctly. My personal favourite is the Monzo year-in-review feature and campaign. This leading UK neobank leveraged spending data to amuse their clients in the app but also in public campaigns (aggregated data only). Monzo used a casual narrative and even joked with some of the users about their spending habits instead of providing dull facts and analysis. It turned out to be hugely engaging, with major positive social and traditional media feedback. AI will make such campaigns easier to deliver.

Source: https://twitter.com/monzo & https://www.dailymail.co.uk/news/article-12880227/monzo-wrapped-spending-banking-app-cash.html

Predictive analytics in banking

Predictive analytics enables banks to anticipate customer needs, behaviours and market trends accurately. By analysing historical data and identifying patterns, algorithms can predict future financial transactions, assess credit risk, detect fraudulent activity and optimise pricing strategies. These insights allow banks to proactively address customer concerns, tailor product offerings and mitigate risk, thereby increasing profitability and competitiveness in the marketplace.

Benefits of omnichannel banking for financial institutions

Omnichannel banking offers several benefits, including higher customer satisfaction, increased engagement and streamlined operations. However, its primary benefit lies in delivering a personalised customer experience across multiple channels, fostering customer loyalty.

Improved customer engagement

By consolidating customer interactions, banks gain a holistic understanding of preferences, behaviours and needs. This insight enables tailored recommendations, promotions and support, increasing engagement and loyalty.

Operational efficiency and cost-effectiveness

Integration of channels and processes enables optimised resource allocation, reduced redundancy and increased efficiency. As a result, banks achieve cost savings and better utilisation of human resources, leading to a more profitable operation.

Access to real-time data

Access to real-time data enables banks to make informed decisions and respond promptly to customer needs. It facilitates trend identification, demand anticipation and proactive problem resolution.

Integration of emerging technologies

Omnichannel banking incorporates technologies such as AI and chatbots that automate tasks, provide instant support, and deliver advanced customer services. The more data points and technologies that are integrated the greater the value. PSD2, PSD3, open finance APIs can enhance the capabilities of omnichannel experience.

For example, AI-powered chatbots can leverage LLM engines and create conversational experience personalising interaction, initiating actions and improving the overall banking experience.

Polish banks are facing pressure to improve customer service efficiency. Our voicebot solution tackles this challenge by utilising AI to automate many frequently asked questions and routine tasks. This frees up valuable time for human advisors to focus on more complex customer issues. If you’d like to see how our voicebot helped a Polish bank streamline their operations, check out our detailed case study!

Barriers and limitations

AI is not a plug-and-play silver bullet for banks. There are reasonable arguments to limit and control how machines interact with end users, especially at this early stage. At the same time, it’s best to explore the AI opportunity, test its performance, and learn how to apply AI-driven automation. Humans will not be replaced anytime soon, but their work can be made easier and more effective if backed by technology.

Conclusion

As you can see, the prospects for omnichannel banking in the financial industry are promising. At Spyrosoft, we’re equipped to help you overcome obstacles, ensure the delivery of excellent customer experiences, drive growth and maintain competitiveness in the era of the digital banking revolution. The future of banking lies in leveraging omnichannel strategies that deliver convenience, personalisation and integrated experiences to customers across multiple channels.

Get in touch with our experts today, fill out the form below and start mapping your omnichannel opportunities for quick wins with Gen AI!

About the author

CONTACT US

Contact me to discuss how we can help you

Our blog