AI in finance: Discover the latest trends

Artificial Intelligence is growing rapidly in every sector, and the broadly understood financial sector is no exception. Banks and other financial institutions are currently looking for ways to make the most of both generative and traditional AI while maintaining high compliance and legal standards. We’ve analysed the latest trends that modern financial companies should be aware of if they want to implement AI (and believe us, they do!).

Firstly, it’s important to understand the current situation when it comes to AI in finance. Almost every big bank claims they are actively using AI for multiple purposes. Artificial Intelligence solutions support areas such as fraud detection, risk management, automated customer service and other financial services. This demand was triggered well before the advent of generative AI. But, the first big question we must ask, is this:

Are we there yet?

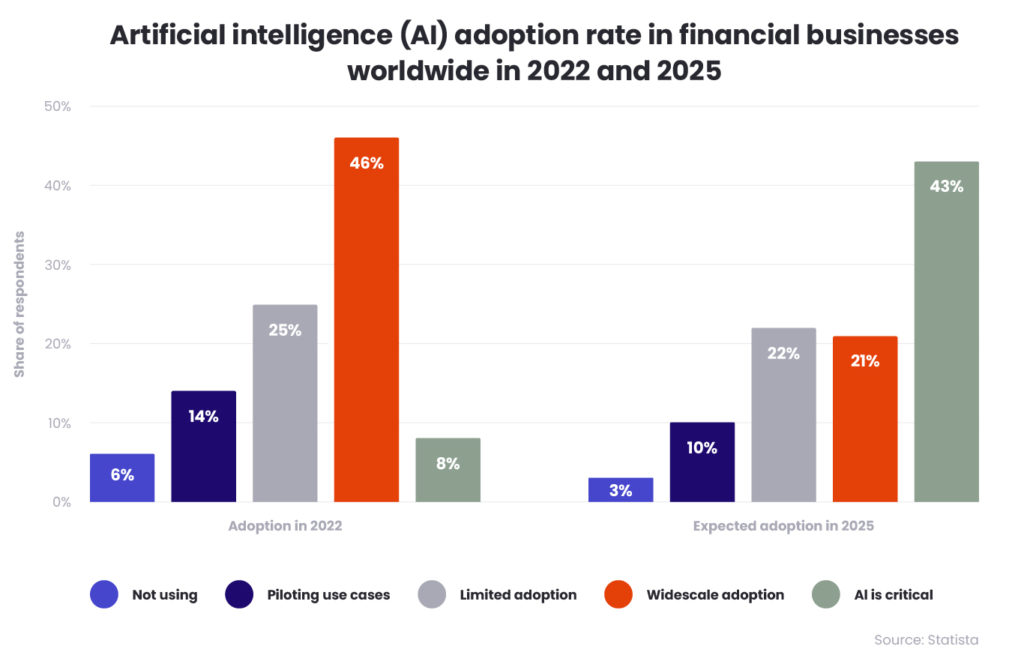

From our perspective, the answer is: almost. Even though AI in finance is surely a dynamically growing trend, there are hardly any solutions that rely on the technology fully. Artificial Intelligence is still treated more as a component of a solution, not a solution itself. Take a look at this chart showing last year’s (2022) and predicted (2025) AI adoption rates in financial companies:

As you can see, back in 2022, 54% of financial companies had a widescale adoption of AI or considered it a critical asset. Worth mentioning here is the fact that in 2022, solutions such as GenAI hadn’t been so popular, since ChatGPT was published on November 30, 2022. The predictions are that in 2025, a higher percentage of companies will consider AI critical to their business than just a supportive element.

Chatbots and voicebots are a perfect example of how recent advances might completely change interaction with clients. A new generation of chatbots and voicebots are capable of having a natural conversation with clients and understanding their needs and requests without asking for hardcoded options. Banks more and more commonly introduce AI-powered chatbots for their customers, but it is important to tightly control their behaviour and leverage Generative AI wisely, as Large Language Models may provide customers with the wrong information or suggestions, which can have severe consequences in this sector. That’s why, usually, the dialog flows must be monitored and managed to keep the communication at the expected but also safe level.

How is AI used in finance: NVIDIA report

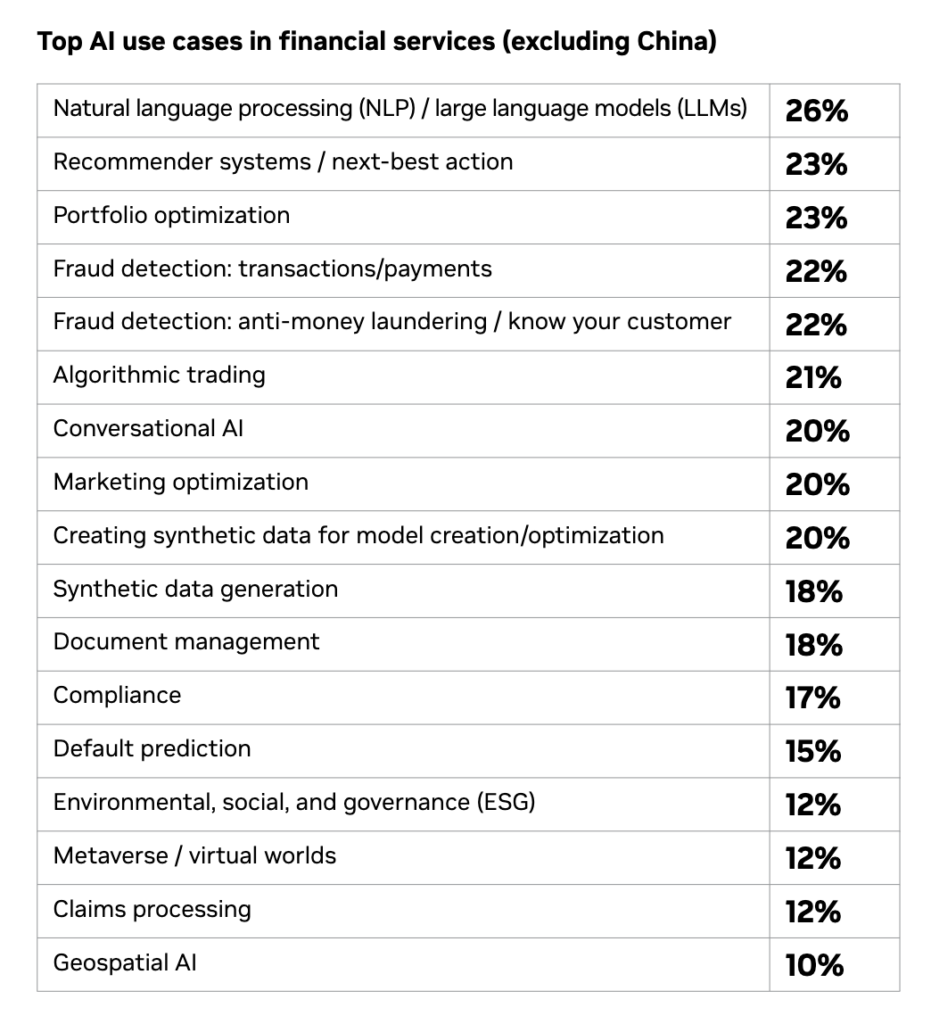

Earlier this year, NVIDIA published a report showing the top applications for AI in finance (excluding China). Interestingly, of the 21 different use cases analysed in the survey, ten are used by over 20% of respondents, which shows big potential for future development:

As you can see, the most popular applications include the use of generative AI (LLMs), but also personalisation systems and portfolio optimisation tools. We also mention these applications in this article.

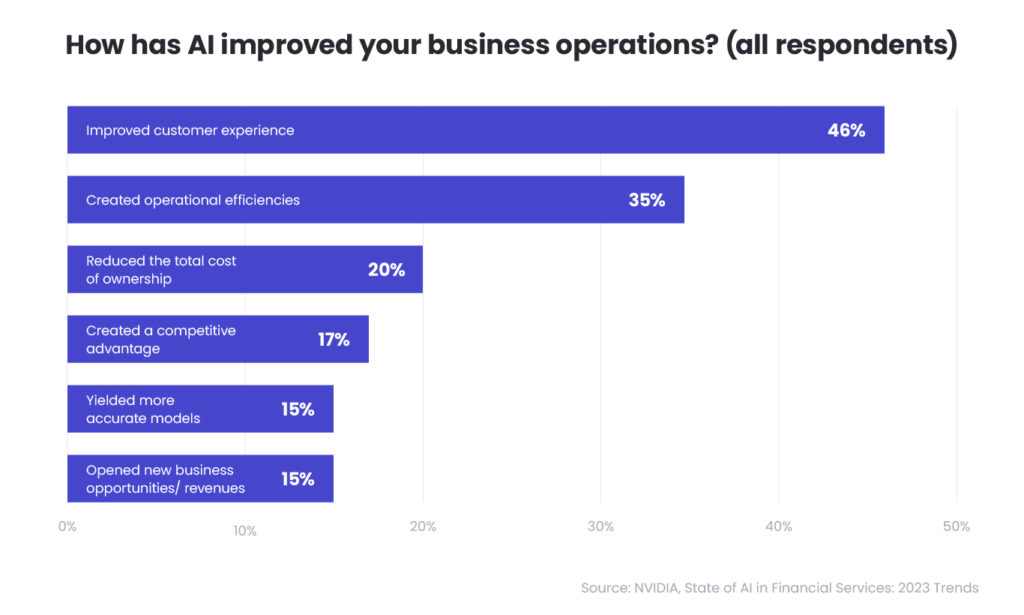

NVIDIA also asked respondents about the results of applying AI in finance in their companies. Not surprisingly, the majority of companies see several significant benefits, with improved CX being number one (almost 50% of answers):

The increasing role of legal regulations

When it comes to the financial sector, not just banks but also legal and regulatory institutions are increasingly interested in the use of AI. Regulatory institutions need to know that AI in finance is, above all, safe and can be used with minimal risk to customers’ personal and financial information.

This is something that’s already happening. For instance, at the end of 2022, the United States issued a nonbinding policy document AI Bill of Rights. The AI Bill of Rights is not specific to the financial sector, but it provides instructive guidance on five fundamental rights that should be considered in the development of policy and use of AI in all industries, including finance and banking.

Similar actions are being taken on the other side of the ocean. The European Union is currently working on the EU AI Act. According to Citi Group, it should be the first comprehensive Regulation of AI which is expected to apply to all industries. The work on it is already at an advanced stage, and its text has been provisionally agreed upon by the appropriate European institutions, providing an opportunity for rapid adoption of the EU AI Act in 2024.

Those regulations have several goals to accomplish:

- They ensure that Artificial Intelligence is used in a safe manner that doesn’t involve any significant risks to customers’ data and decisions.

- They curb potential fraud risks and introduce necessary safety measures.

- They minimise the risk of bias when it comes to dealing with customers representing different nationalities and ethnicities.

The growing number and complexity of financial regulations will likely trigger the advent of more RegTech (Regulation Technology) tools and companies. RegTech allows financial institutions to more efficiently manage the ever-growing number of regulatory requirements they must comply with (source: Alexa Translations).

Use of AI and transition to generative AI

As we’ve already mentioned, banks and other financial institutions use AI heavily to support employees, serving customers and obtaining the necessary information.

In the financial sector, the integration of AI is a strategic imperative, not just a technological upgrade. AI’s role extends beyond automating routine tasks; it’s about enhancing analytical depth and operational efficiency. Financial institutions are now harnessing AI to refine decision-making processes and optimise client services. This shift is less about replacing human roles and more about augmenting human capabilities, allowing teams to focus on strategic initiatives and client engagement. We see AI as a critical driver in the future of finance and innovation reshaping the industry.

Tomasz Smolarczyk, Head of Artificial Intelligence at Spyrosoft

One of the most popular Generative AI use cases is within customer service teams where they are enabling teams to work with customers in a more effective way. This is where the role of generative AI is becoming increasingly important. Banks want to use this technology because of the tremendous potential it offers.

Smart AI-powered tools can help banks with tasks such as:

• Quicker document analysis: Why read a 50-page mortgage agreement when AI can do it for you in a matter of seconds?

• Finding the necessary documents and files: Thanks to AI, we can create super-advanced semantic search engines that are capable of looking for documents (even scans) with specific pieces of information.

• Generating summaries of documents: With generative AI, we can easily generate reports and summaries for internal uses.

• Providing customers with all the required information: AI can support employees during conversations with customers, by giving them instant access to all the crucial information that’s being discussed during a conversation.

• KYC procedures: With AI, banks have access to enhanced due diligence (EDD) and customer due diligence (CDD) procedures, as well as other compliance measures. As a result, they can verify new customers in an effective and automated way.

The game is surely worth the candle! Deloitte predicts that the top 14 global investment banks will be able to increase front-office productivity by an average of 25% thanks to generative AI. This could translate to earning additional revenue of $3 million per front-office employee as soon as 2026 (source: PR Newswire).

Discover our AI-based offerings!

Find out moreUse case: “internal ChatGPT”

For one of our clients here at Spyrosoft, we built a chatbot that’s based on Azure OpenAI models (the same as ChatGPT) but works fully in the client’s internal cloud ecosystem and is intended to support employees in their daily tasks and communication with customers. Because everything is developed internally (we used Microsoft Azure), all the conversations conducted by employees are not used to train any language models and there is no risk of leaking any confidential or sensitive data to the market.

Such a solution is safe and effective and customer service agents’ work is streamlined significantly – they don’t need to spend a lot of time structuring notes or documents, brainstorming ideas, or writing emails.

It’s not a revolutionary approach. There are dozens of tools that are based on the language models developed by OpenAI, and they are used to achieve a whole range of different results.

A new approach to AI in finance: personalised cross-selling

The integration of Generative AI in finance is paving the way for a more personalised approach to cross-selling. By harnessing this technology, financial institutions can tailor their offerings to each customer’s unique needs and preferences. The potential of AI lies in its ability to analyse vast amounts of data to identify the most relevant financial products, such as credit and debit cards, for individual customers. This targeted approach goes beyond traditional methods, engaging customers through intelligent, conversational interfaces within digital banking apps. Imagine a smart assistant that not only informs customers about the latest card offers but also explains their specific benefits in a context that resonates with the customer’s financial goals. This level of personalisation enhances customer experience, making interactions more engaging and increasing the likelihood of successful cross-selling. Ultimately, Generative AI stands to transform customer communication in finance, leading to higher conversion rates and a more nuanced understanding of customer needs.

Customer personalisation

This is another interesting field of generative AI application. With access to customer data and their purchasing habits, AI algorithms can provide customers with personalised information on how to improve their finances and what they can do to manage their home budgets more effectively.

That’s what British TSB Bank is working on right now:

We want to use AI and ML to identify key events in the customer’s life that might necessitate financial support and use that response to help customers ultimately achieve their life ambitions.

With the use of AI in finance, banks can personalise product recommendations, suggestions on spending habits, and even investment opportunities.

The challenge of developing AI for less-common languages

In the realm of Generative AI, English understandably takes the lead due to its global prevalence. Developing AI solutions in English is more straightforward because of the vast array of existing resources and models. However, tailoring these solutions for less common languages, especially those with unique linguistic structures like Polish, presents a distinct set of challenges. The complexity lies not in starting from scratch, but in gathering enough training data and adapting and refining existing models to accommodate the nuances of these languages. Despite these challenges, progress is being made. A prime example is boost.ai‘s success in the Nordic countries. Their ability to effectively adapt AI solutions to Nordic languages demonstrates that with the right approach and dedication, it’s feasible to extend sophisticated AI capabilities to a broader linguistic spectrum. This success story provides valuable insights and methodologies for developing AI tools in other less-common language spheres, paving the way for more inclusive and diverse AI applications.

Wrapping up

Banks and other financial institutions will surely use Artificial Intelligence more and more frequently, especially the generative kind. This direction is obvious, and some solutions are already in place, even though there is still a lot to achieve. We still need to solve some of the pressing challenges, including compliance with privacy regulations and solutions for non-English-speaking countries. But there’s no doubt we will eventually get there!

And if that’s your goal as well, reach out to us using the contact form below, and let’s see what we can do together!

About the author

Contact us