How CRM-driven scoring helps prioritise high-value broker leads

It’s 1997 and you want to buy life insurance. You talk to your agent, who submits your request, and then you wait, sometimes for days. When the response finally arrives, it’s usually a PDF or fax that you have to decipher, print, sign and scan back. Only then is your insurance in place.

Even though in 2025 digital signatures have eliminated the need to print documents, the overall experience remains frustratingly similar. Confusing forms, lengthy back-and-forth communication and long waiting times are still commonplace. Behind the scenes, many brokers still rely on time-consuming manual tasks such as copying information from emails into multiple systems, chasing missing details and making decisions based on instinct or spreadsheets rather than streamlined automation.

Using CRM data to score broker enquiries offers a game-changing solution. By integrating advanced tools like X Genie with existing CRM systems, insurers can automate the extraction, enrichment, and analysis of enquiry data in real-time. With those capabilities, underwriters and sales teams are able to make data-driven decisions, focusing their efforts on leads with the highest likelihood of conversion and profitability.

In this article, we explore how automation and CRM platforms help insurance companies maximise the full value of their broker enquiry data, enabling smarter lead prioritisation and more effective underwriting strategies.

Too many enquiries, too little time

A common challenge faced by insurance teams is having too many enquiries and too little time. This is particularly true for underwriters, who receive an overwhelming volume of offers submitted by brokers.

The core issues are:

- Underwriters waste valuable time evaluating leads that have a low chance of converting into profitable business due to the sheer volume of enquiries.

- Manual lead scoring processes are inefficient and often subjective, leading to inconsistent prioritisation and potential missed opportunities.

- Multiple brokers submitting offers can cause confusion and inefficiency, as insurers may receive inconsistent information and face market blocking when approached numerous times for the same risk, thereby reducing the chances of a successful placement.

This situation results in underwriters being bogged down by low-quality leads, which diminishes their productivity and effectiveness. The lack of a streamlined, objective lead scoring system means time is spent on less promising enquiries, reducing the overall conversion rate and profitability.

The role of a broker CRM system

A broker-customer relationship management system serves as a centralised repository for managing interactions, data, and relationships with insurance brokers. It aggregates a wide array of information, including:

- Broker profiles – comprehensive data on individual brokers, including contact information, business volume, areas of specialisation, and historical performance metrics.

- Enquiry history – a detailed log of all past enquiries submitted by each broker, providing insights into their activity patterns and the types of risks they typically represent.

- Transactional data – records of all policies sold through each broker, including premiums, commission structures, and claims history.

- Performance metrics – key performance indicators such as conversion rates (enquiries to policies), average policy size, and profitability ratios.

A robust broker CRM system offers much more than just data storage. It provides a range of advanced capabilities that promote operational excellence throughout the insurance value chain. It automates data integration by consolidating information from internal systems, email platforms, and third-party data providers., which ensures that broker profiles are always accurate. The system supports customisable scoring models, enabling insurers to define and refine lead scoring algorithms according to shifting business priorities, risk appetite and historical performance, ensuring that prioritisation always aligns with strategic objectives.

Another key feature is workflow automation, which streamlines repetitive administrative tasks such as follow-ups, document management, and scheduling. This automation allows underwriters and sales teams to dedicate more time to high-value activities rather than manual processes. Real-time analytics and reporting provide actionable insights via interactive dashboards, equipping decision-makers with the tools to monitor broker performance, identify emerging trends and optimise engagement strategies.

The CRM system incorporates secure data management practices, including access controls, audit trails and data encryption, to protect sensitive information and ensure compliance with industry regulations such as the GDPR, as well as local insurance laws. It also fosters collaboration and transparency by supporting shared notes, role-based access, and workflow tracking. This means that all stakeholders can see the status of each lead and broker interaction.

How should CRM fuel smarter broker management

A well-implemented CRM system should serve as the strategic command centre for broker management, providing underwriters and sales teams with instant access to historical data, risk profiles, conversion rates and profitability metrics, enabling them to make faster and smarter decisions. It should also help insurers to assess which brokers are worth prioritising, which leads carry real business value and how resources should be allocated for the greatest return. In practice, however, this rarely happens.

Through X Genie’s integration with CRM systems, our solution effectively identifies when a new insurance quote is lower than a customer’s historical price. X Genie leverages stored customer data to detect these discrepancies, safeguarding against revenue loss.

Paweł Stezycki, Principal Consultant, Financial Industry & AI

CRMs are often underutilised or poorly integrated, forcing teams to rely on gut instinct, spreadsheets or incompatible systems. This is where X Genie steps in. It transforms the way CRM data is extracted, enriched, and used by automating the analysis of incoming enquiries. It finally delivers the real-time insights that insurers need to prioritise high value leads with confidence.

Streamlining data workflows with X Genie’s automation

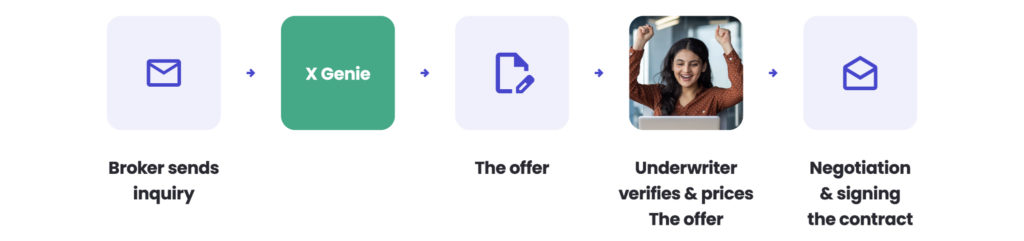

X Genie’s new integration option allows seamless connection to a client’s CRM system, transforming how insurance companies manage broker enquiries. This integration automates the entire process of extracting, enriching, and scoring incoming broker requests.

This type of integration enables companies to maximise the value of their CRM data, transforming it into a powerful tool for efficient underwriting and informed decision-making. X Genie automates data extraction and enrichment to speed up response times, reduce manual workload and improve conversion rates, ultimately increasing company profitability up to 67%.

Paweł Stezycki, Principal Consultant, Financial Industry & AI

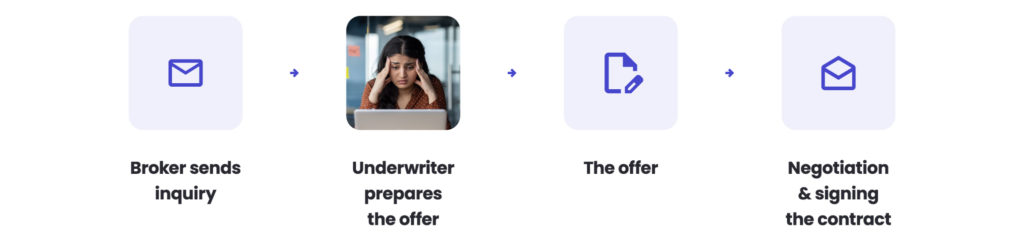

In practice, the workflow operates as follows:

Automated data extraction

X Genie automatically detects new offers or enquiries submitted by brokers and extracts key data points, including the broker’s identity, the specifics of the enquiry, and the historical context.

Real-time CRM synchronisation

The extracted data is immediately pushed into the insurance company’s CRM system, which enriches existing broker profiles with up-to-date enquiry information, ensuring the underwriting team works with comprehensive and current data.

Smart inquiry scoring

Using CRM insights like history, conversion rates and enquiry patterns, X Genie applies an automated scoring model to each enquiry received.

Actionable prioritisation

Based on the scores, underwriters and agents can quickly identify which enquiries warrant immediate attention and which can be deprioritised. For example, enquiries from brokers who frequently submit requests but rarely convert are flagged as low priority, allowing teams to allocate resources more effectively.

Offer optimisation & acceleration

X Genie goes beyond scoring by automatically suggesting appropriate clauses tailored to each enquiry, as well as generating a draft offer proposal for agent review and pricing. This ensures a higher level of offer standardisation, significantly reducing manual effort and shortening turnaround time, which helps underwriters respond faster and more consistently.

Benefits of prioritising high-value broker leads through CRM scoring

Increased efficiency

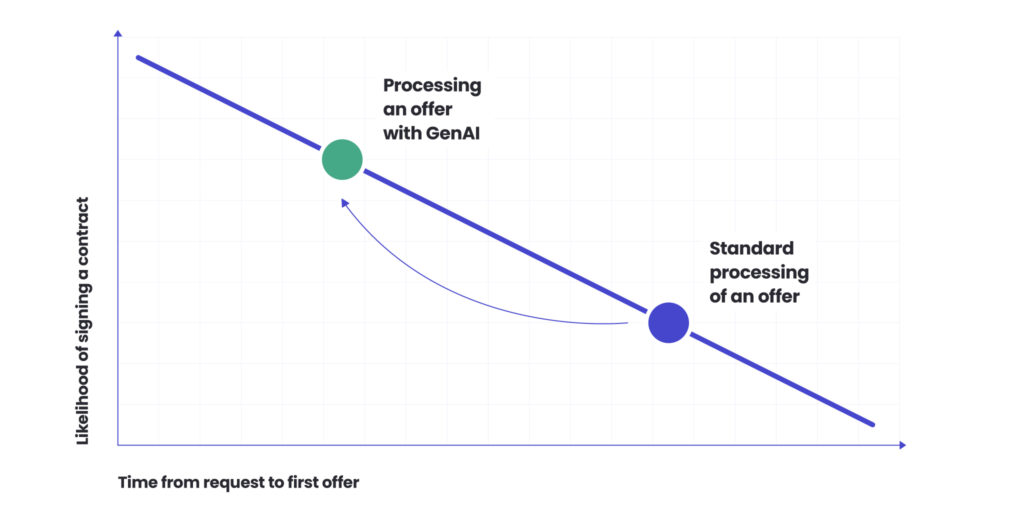

CRM-driven lead scoring allows insurance companies to focus their efforts on broker enquiries with the greatest potential for generating profitable business. By automatically ranking leads based on engagement, demographic fit and sales readiness, sales and underwriting teams can avoid wasting time on unqualified or low-value leads.

Higher conversion rates & improved profitability

Prioritising leads to better sales outcomes. When brokers with strong potential receive timely, personalised attention, they are more likely to become customers. This focused engagement increases conversion rates and enhances profitability by reducing acquisition costs and improving the quality of new business. Furthermore, CRM systems can identify cross-selling and upselling opportunities within existing broker relationships, thereby boosting revenue even further.

Reducing human error

Automated lead scoring within CRM systems applies standardised criteria to evaluate all broker enquiries objectively. This eliminates the subjective biases and inconsistencies that can arise when prioritisation relies solely on manual judgment. By ensuring that every lead is assessed fairly and systematically, insurers can reduce the risk of overlooking valuable opportunities or allocating resources to less promising leads.

Enhanced customer experience

Using CRM data enables insurers to customise communications and interactions according to each broker’s profile, history and behaviour. Personalised engagement, such as targeted follow-ups, relevant product recommendations and timely responses, helps to build stronger relationships and trust with brokers. Faster, more relevant interactions improve satisfaction and loyalty among brokers, both of which are critical for long-term retention and repeat business.

Streamline underwriter’s work and process twice as many offers

In the insurance industry, leveraging CRM-driven lead scoring is essential for efficiently and effectively prioritising high-value broker enquiries. Integrating advanced automation tools such as X Genie with your CRM system provides real-time insights and predictive analytics, empowering your underwriting and sales teams to focus on the most promising leads. This data-driven approach will boost profitability and operational efficiency while enhancing broker relationships through timely, personalised engagement.

Read our latest case study and find out how Compensa Insurance Company S.A., increased their offer processing capacity fivefold without hiring more staff. Our secure, AI-powered data extraction solution enabled automation and standardisation, reducing the time taken for the first response and significantly improving customer satisfaction. With a unified contract template and centralised clause management, the bidding process is now more streamlined and effective.

Partner with us for AI-driven insurance management

Our experts are ready to implement CRM-driven scoring solutions that will streamline your workflows, improve resource allocation and deliver consistent business value. Contact us today to find out how X Genie can help your insurance business to prioritise more intelligently, respond more quickly and grow stronger.

About the author

Contact us