AI modernisation: Transforming legacy banking systems

In an era of increasing digitalisation, many traditional banks have taken steps to adapt to the new realities. Technology is evolving at a breakneck pace, and many in the banking industry need guidance on which digital solutions to implement.

Although existing platforms still perform their original functions, over 40% of banks still rely on COBOL, a programming language dating back to 1959, as the backbone of their legacy systems. The technological revolution has brought new tools to everyday life and changed consumer behaviour and expectations. Traditional banking models are becoming less efficient, delivering lower profits and facing increasing competition from new entrants. As a result, banks are moving towards platform-centric models like BaaS that prioritise customer interactions and ensure services are seamless and intuitive.

Let’s examine why it’s worth modernising outdated systems and outline strategies for updating banking platforms. This will help you recognise the signals that indicate the need for modernisation and familiarise you with the benefits of modernising the infrastructure.

The role of AI in modernising banking systems

According to a survey by the Economist Intelligence Unit, 77% of bankers believe that AI adoption is the critical differentiator between winning and losing financial institutions.

Many applications of artificial intelligence include personalised customer service through chatbots and virtual assistants, predictive analytics for risk management, and real-time fraud detection systems. Implementing this technology facilitates modernising supporting systems, such as data management and cybersecurity, ensuring their robustness and efficiency. Also, AI has transformed online banking, offering seamless transactions, personalised financial advice and innovative services like robo-advisors. These advances improve the customer experience, reduce operational costs and mitigate risk, potentially adding up to $1 trillion in value to the banking sector each year.

For one of our clients, a global banking group, we have designed a robust application, capable of handling complex processes while maintaining user-friendliness. The system had to adhere to international banking standards for reporting and credit reserve calculation to minimise human error and ensure the accuracy and reliability of data. The application also aimed to automate workflows to improve operational efficiency and reduce reliance on paper-based processes, aligning with the bank’s sustainability initiatives. Ensuring scalability and the security of sensitive financial data in this project was paramount.

Why it is worth to modernise outdated systems

Modernising obsolete legacy systems is a strategic step for any organisation looking to remain competitive and achieve success. According to 80% of IT leaders, failing to modernise IT systems will hinder their long-term growth, highlighting the widespread recognition among industry experts that upgrading is essential.

Answering the question of why it is worth investing in modernising these systems, here are some reasons:

Improved performance and efficiency

Legacy systems are often modernised by upgrading outdated hardware and software, streamlining procedures, and integrating new technologies. This process can lead companies to faster processing times, reduced downtime, and smoother operations. Thanks to increased performance, the system can manage higher volumes of data and transactions more effectively. Improved efficiency eliminates bottlenecks and manual intervention, allowing banking personnel to focus on more critical responsibilities.

Competitive advantage

Organisations that modernise their outdated systems can react faster to market developments and client needs. They are able to benefit from new features, services, and technology that competitors could not offer, establishing themselves as leaders in innovative approaches. With agility and the ability to grow quickly, banks may differentiate themselves in the market, acquiring new clients while retaining old ones through superior products and services.

Improved data security and confidence

Legacy systems are often vulnerable to security breaches due to outdated protocols and updates. Modern systems use advanced security measures such as advanced encryption, multi-factor authentication and regular security patches, which significantly reduce the risk of cyber-attacks and data breaches and ensure the protection of sensitive data.

Cost reduction and long-term savings

The initial investment in upgrading older systems can be significant, but it will result in substantial financial savings over time. Modern systems are reliable and require less maintenance, reducing ongoing operating costs.

Let’s look at the example of The Royal Bank of Scotland Group, which has been modernising its technological infrastructure since the government bailed it out following the 2007 banking crisis. The bank’s efforts have focused on re-platforming its legacy systems from physical servers to virtualised and cloud-based services, using private and public cloud solutions from AWS and Microsoft Azure. This move to modern platforms has enabled the implementation of automation, resulting in savings of approximately $9 million in manual server processes within two years of implementation.

Strategic opportunities for banks that integrate BaaS

As customer dissatisfaction with traditional banking services continues to grow, integrating Banking-as-a-Service (BaaS) presents a critical opportunity for financial institutions to innovate and differentiate themselves in the marketplace. BaaS enables banks to leverage technology platforms to deliver seamless financial services to their customers, meeting evolving demands.

With 30% of customers considering switching banks and 42% using ‘buy now, pay later’ services, the demand for flexible and accessible financial solutions is straightforward. Banks that leverage Banking-as-a-Service can meet changing preferences and reap significant economic benefits, such as a potential doubling return on average assets (ROAA).

Given these significant benefits, banks can focus on three key areas to maximise the potential of BaaS:

Improve customer experience through embedded finance: Banks can offer embedded finance solutions that significantly enhance the customer journey by integrating banking services directly into non-financial platforms. For example, they can provide loans at the point of sale or integrate payment solutions into ride-sharing apps. Such seamless integration improves customer convenience and engagement, making financial services a natural part of everyday activities and purchases.

Leverage data-driven insights: BaaS platforms give banks access to vast amounts of data, enabling them to gain deeper insights into customer behaviour and preferences. By leveraging advanced analytics and artificial intelligence, they can offer more relevant and timely financial products, improving customer satisfaction and loyalty. For example, predictive analytics can help banks identify customers interested in mortgage refinancing based on their spending patterns and financial history, enabling proactive and personalised service offerings.

Ensure robust security and compliance: Modern BaaS platforms are designed with robust security features and compliance tools to help banks meet regulatory requirements. These features ensure that customer data is protected, and regulatory obligations are met, reducing the risk of penalties and increasing customer confidence. By leveraging these built-in capabilities, banks can streamline compliance processes and focus on delivering value-added services rather than getting bogged down in regulatory complexities.

Incorporating BaaS is a strategic move that positions banks to capitalise on new opportunities, improve customer experience and drive innovation. Take advantage of our expert guidance and find out how BaaS can help your institution attract and retain customers while optimising financial performance.

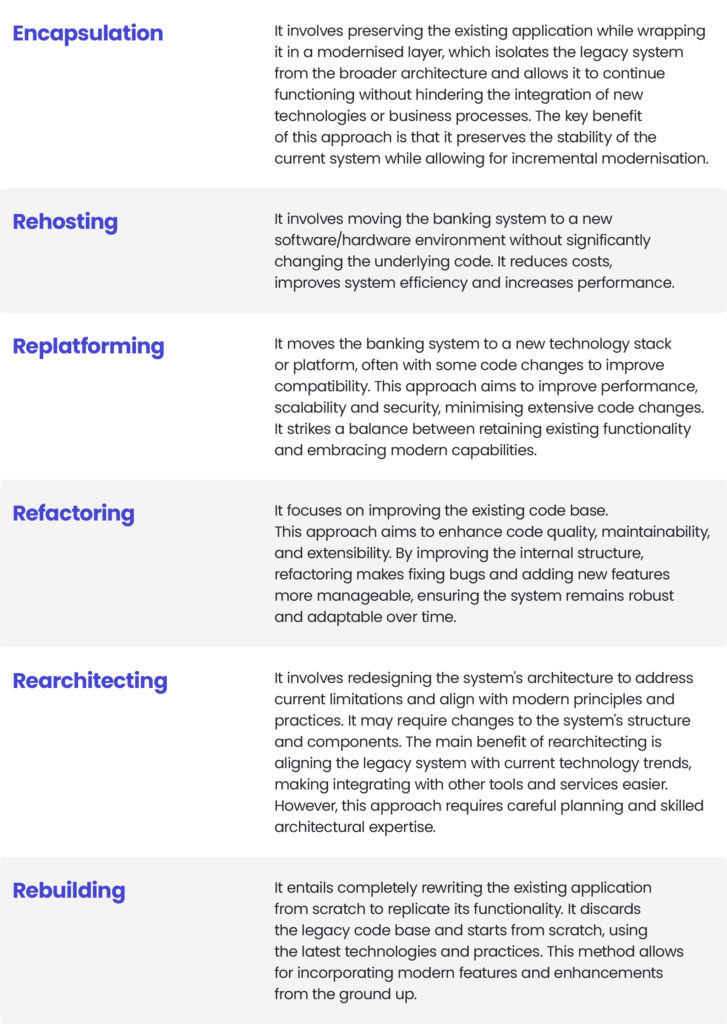

Key modernisation approaches

Several approaches to modernisation exist, each dealing differently with code and legacy infrastructure. Let’s examine each of these methods.

Warning signs that your legacy financial system needs an update

Decreased efficiency ratio

When the efficiency ratio falls, it often signals a decline in operational efficiency. Legacy systems can slow down processing times and increase the potential for errors, negatively impacting the overall efficiency of the banking system. Employees may resort to manual workarounds to overcome system limitations, which are time-consuming and error-prone. In addition, legacy systems often require more human intervention and maintenance, limiting overall efficiency.

Longer time-to-market with new products

The long time it takes to bring new products to market is a critical indicator that a financial system needs to be upgraded. Legacy systems may have difficulty integrating new technologies and may not support modern development practices, resulting in extended development and release cycles. These banking systems often lack the flexibility to accommodate rapid changes or new functionality, delaying the introduction of new products and services.

Increased Total Cost of Ownership (TCO)

As systems age, maintenance costs tend to rise due to the need for specialised skills, which can be costly and hard to find as technologies become obsolete. Frequent outages and increased system failures lead to higher repair costs and lost productivity. Integrating legacy systems with modern applications can be challenging and expensive, contributing to increased operational costs.

Time-consuming implementation of regulatory changes

Keeping up with regulatory requirements using outdated systems can be cumbersome, as these systems may not easily support necessary updates or new compliance features. Legacy systems are often rigid, making it difficult to implement even minor changes without extensive reworking. Delays in updating systems to meet regulatory standards can result in non-compliance risks, potentially leading to fines and legal issues.

Why you should partner with Spyrosoft for modernisation projects

Modernising legacy banking systems can be daunting. It involves thoroughly analysing existing applications, selecting the optimal modernisation strategy, and seamlessly implementing changes. The complexity and risks associated with these projects can be challenging.

However, choosing the right digital modernisation partner can simplify this process. Our case study on transforming legacy code documentation with GenAI demonstrates our expertise and successful results.

Contact our expert directly by filling up the form below for more information on how we can support your banking system!

About the author

Contact us

Contact me to discuss how we can help you

Recommended articles