Doubled efficiency in document processing with AI automation

Impact

-

2 times more

offers processed by the same team -

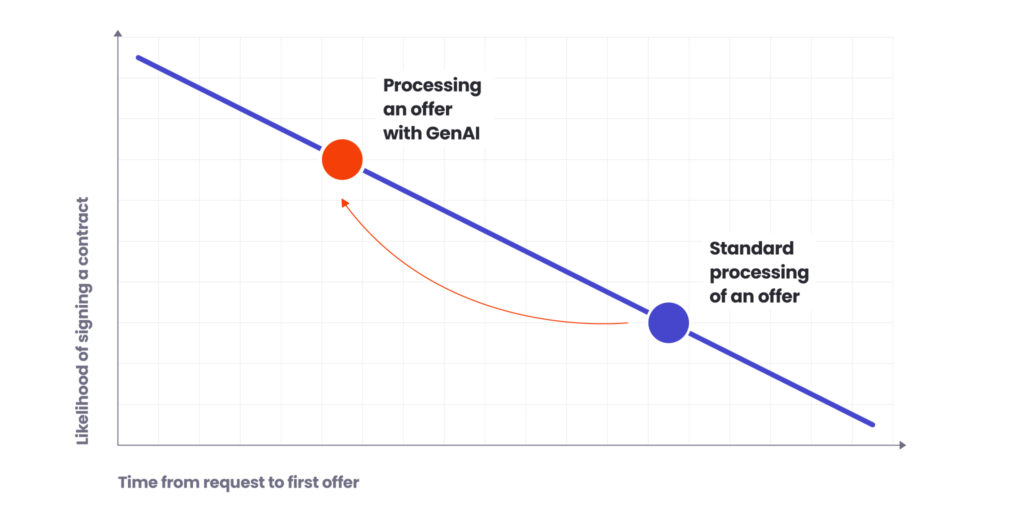

5 times faster

first response to the client, increasing the number of signed contracts -

One contract template,

standardised way of bidding and control over clauses

Technologies

- Azure OpenAI

- LLM model GPT-4o

- LangChain

- Chroma Db

- Microsoft Graph API

- Azure DevOps CI/CD

Challenge

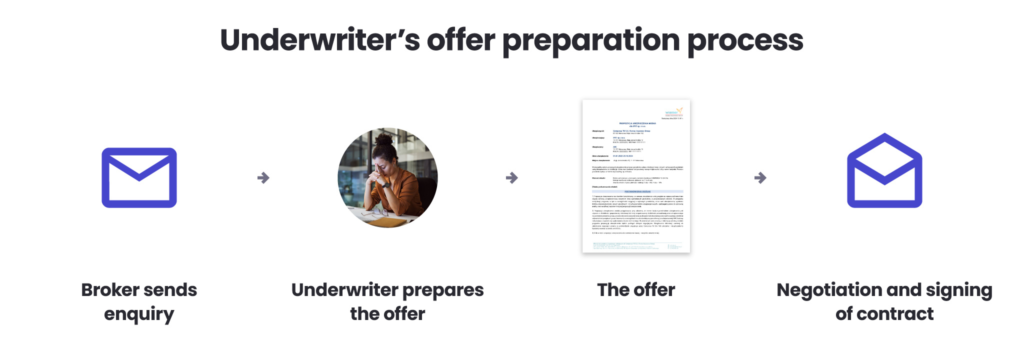

Compensa processes several thousand corporate offers each year, which requires underwriters to manually transfer data from broker documents into insurance offers. This manual data transfer is time-consuming and can lead to inconsistencies in document wording and layout. Brokers often do not operate on Compensa clauses and use different field naming conventions, different section orders and the length of documents often varies from 4 to 50 pages.

Even a single underwriter may generate documents in different formats, as they cooperate with many agents, and each can prepare documents using different templates. Preparing an offer can take up to an hour, and attempting to standardise them manually would require additional time that specialists could utilise for other tasks.

The solution

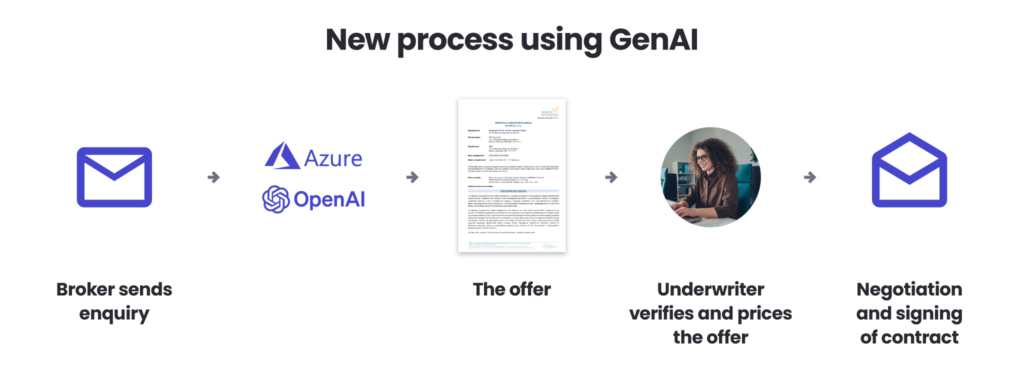

Compensa aimed to standardise the layout of its contracts and automate repetitive tasks, thereby relieving underwriters and allowing them to focus on correctly estimating the offer and negotiating with customers, rather than copying and pasting data from documents.

To achieve this, we proposed the development of an AI-based algorithm to extract essential information and generate a formatted response – an initial offer to be reviewed by an underwriter. This extracted information would include details about brokers, insurers, insured parties, and specifics regarding insurance products, coverage amounts, types, clauses, and other critical data. The solution would establish a consistent template across the company, unifying and centralising all contracts.

We designed a solution within the secure Azure environment, which is critical for meeting the strict data handling regulations in the financial sector. The solution incorporated Azure OpenAI’s ChatGPT model, in which we implemented custom parsers, chain-of-thought reasoning, and a validation layer to ensure accurate data extraction. Key integrations included LangChain for seamless data flow, Chroma DB for embedding storage, Microsoft Graph API for secure email connectivity, and Azure DevOps CI/CD pipelines for streamlined deployment. We also developed a vector database with expert-defined logic for handling cases beyond the AI’s scope.

The result

The solution has doubled or even tripled the processing speed of documents, depending on the complexity of the request. Now, instead of spending hours manually completing the files, the underwriter only verifies the correctness of extracted data, which takes a few minutes. The same team processes contracts much faster, resulting in shorter time-to-first response to clients and an increase in signed contracts. The document template is standardised, and the wording of contracts is easier to control thanks to a database of clauses that is managed by designated people.

Contact

Let’s talk about your project

Case Studies