How to achieve WCAG 2.1 compliance for banking services in the EU?

Digital accessibility is no longer just a good practice – it is becoming a legal obligation across the European Union. The European Accessibility Act (EAA), coming into effect in 2025, mandates that essential digital services must be inclusive and functional to all users, including those with disabilities. At the heart of these requirements is the Web Content Accessibility Guidelines (WCAG) 2.1, a globally recognised standard for digital and web accessibility. These regulations are particularly impactful for the banking sector, as financial institutions increasingly rely on online platforms to serve customers. With that in mind, we delve into the regulation, its principles, benefits, and how our experts can help you prepare for WCAG 2.1 compliance.

WCAG 2.1 compliance and its relation to the EAA

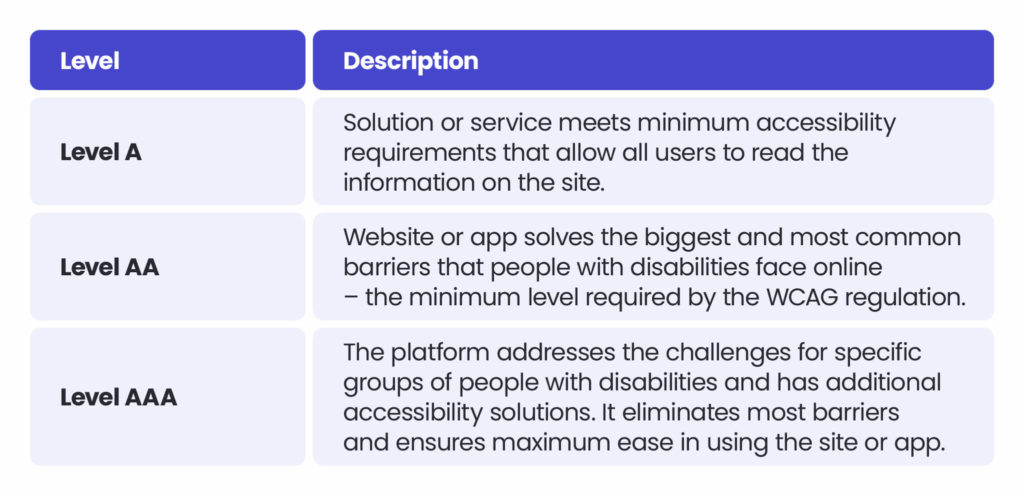

The Web Content Accessibility Guidelines (WCAG) 2.1, created by the World Wide Web Consortium (W3C), provide a framework for making web content and digital services more accessible. It indicates how to design and develop websites, applications, and systems so that people with various types of disabilities (e.g., vision, hearing, or movement), as well as cognitive and perceptual disorders or limitations, can use them without restrictions. The guidelines are categorised into three levels of compliance: A, AA, and AAA, with AA being the standard typically required by regulations.

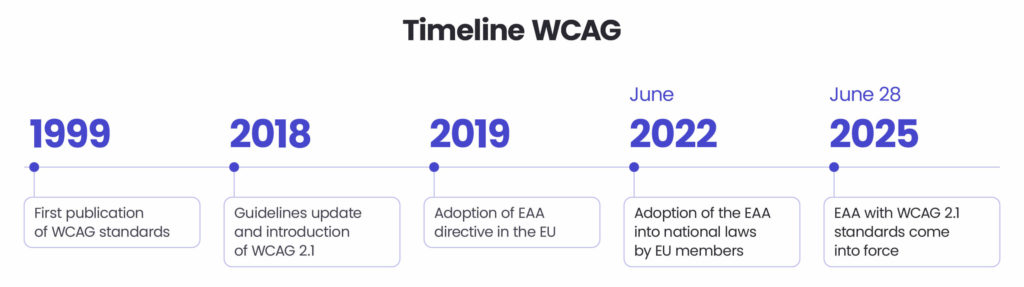

Until recently, compliance with WCAG standards in the EU was only mandatory for public institutions. For many private companies, they represented only a suggested set of best practices. However, this state is about to change. With the implementation of the EU’s EAA directive, which includes WCAG 2.1, various businesses will be required to follow these rules in their digital products and services. The directive will come into full effect on June 28, 2025. Regulated industries include banking and finance, ecommerce, mass transportation, telecommunications, and audiovisual services, among others.

Adopted for the first time in 2019, the EAA is a legislative directive introduced by the EU. It aims to ensure that key digital services and products are accessible to all users, by setting common rules and standardising requirements between members. The law applies to companies in various sectors doing business within the EU, and failing to comply after June 2025 may result in penalties and fines.

Foundations of WCAG 2.1 compliance

WCAG 2.1 is based on four key principles, commonly known as POUR: perceivable, operable, understandable and robust. They serve as the foundation for making digital content accessible to all users, including people with disabilities. By following these rules, banks can create an inclusive digital experience that meets customers’ needs, ensures compliance, and increases engagement.

Perceivable

All content, information, and interface components must be presented so that users can easily perceive it, regardless of their cognitive and sensory abilities. Your digital platform should offer solutions to support people with visual, hearing, and motor disabilities. This includes providing text alternatives for images, captions for videos, responsive layouts, and sufficient colour contrasts, ensuring content is adaptable for different assistive technologies.

Operable

Users must be able to navigate and interact with digital content effectively. Your digital solution should be easy to operate for each individual, allowing them to find information and move around the platform seamlessly regardless of the interface support tools they use. This involves making all functionalities available via a keyboard, providing enough time to complete actions, and designing with accessibility-friendly practices in mind.

Understandable

Content and the operation of the UI must be clear, understandable, and intuitive. This means providing readable and plain text, consistent and predictable navigation, and input assistance such as suggestions and form instructions to prevent and correct mistakes.

Robust

Digital content must be compatible with a wide range of technologies, including current and future assistive tools. This ensures that your digital banking services remain functional across different devices, screen readers, and browsers.

Benefits of WCAG 2.1 compliance

In addition to the key assurance that digital products and services comply with EU regulations, thereby mitigating legal risks and potential fines, implementation of WCAG 2.1 regulations can bring many benefits to the business:

- Enhanced user experience – Inclusive and user-friendly digital platforms provide better experiences for all customers and boost their satisfaction.

- Broader market reach – By removing digital barriers, your services and apps can reach a wider audience, including individuals with disabilities, elderly clients, and those with temporary limitations.

- Brand reputation and loyalty – Embracing accessibility demonstrates a commitment to inclusion, helps increase trust, and fosters stronger customer relationships, thus building brand loyalty.

- Higher engagement and conversion rates – Improved usability often leads to increased engagement and a higher likelihood of customers completing transactions or using banking services.

- Reduced customer support costs – A well-designed, accessible platform minimises the need for additional customer support by ensuring users can navigate and interact with banking services independently.

Steps to ensure WCAG 2.1 compliance

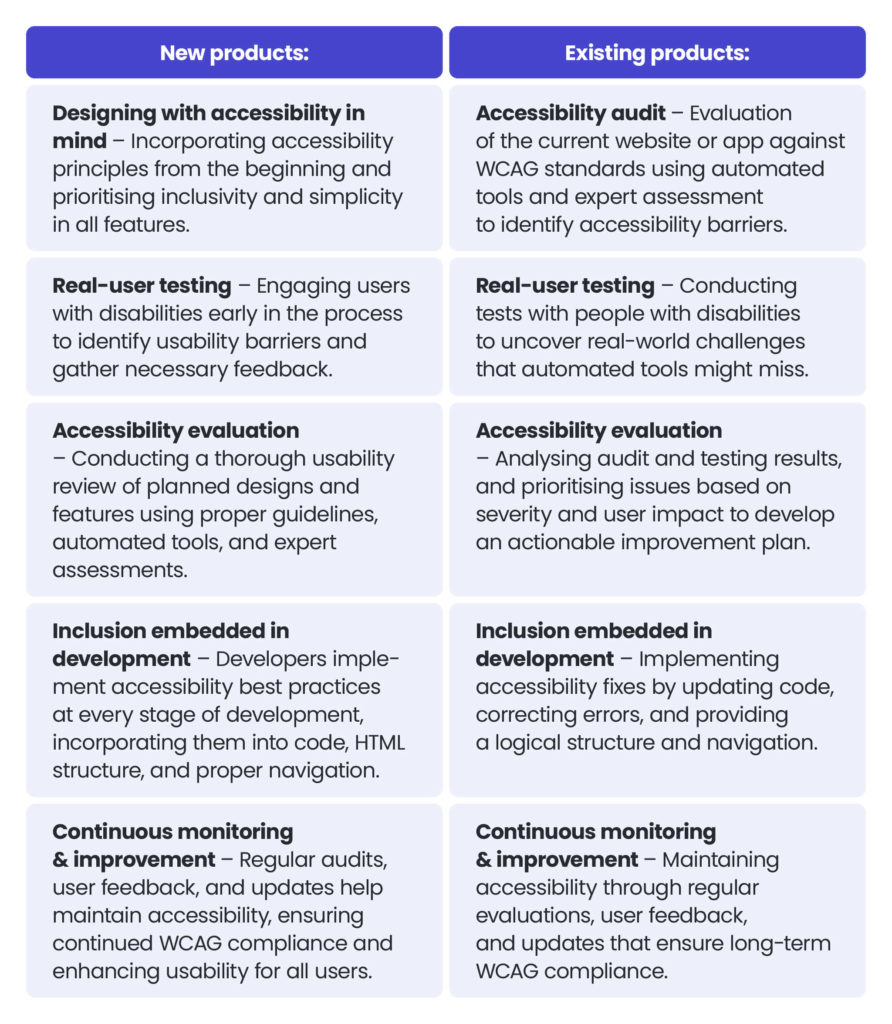

Creating accessible products is an integral part of our design and development process. That’s why we keep this aspect in mind at the beginning and throughout the entire project lifecycle. Drawing from our experience in projects for both banking and other industries, we have developed a process that efficiently deploys WCAG standards into your solution. Moreover, the process is flexible and can easily be modified to suit your needs, regardless of whether you are creating a new platform or app from scratch or adjusting and upgrading an existing one.

When implementing WCAG standards in new solutions from the ground up, accessibility is embedded into the design and development phases from the very beginning. This includes conducting accessibility research, choosing inclusive design patterns, ensuring proper colour contrast, keyboard navigation, and screen reader compatibility, as well as continuously testing throughout development to maintain compliance.

For already functioning websites, platforms, or apps, the process includes conducting an accessibility audit against WCAG and ADA guidelines to identify areas for improvement. Additionally, we conduct user tests that involve people with disabilities to detect further usability issues. Based on the audit and research results, we prioritise the development of necessary actions and updates. This may include, e.g., improving navigation structures, adding alternative text for images, ensuring proper HTML structure and semantic or compatibility with supporting tools. Once we have implemented the improvements and ensured compliance, we also provide ongoing monitoring, evaluation, and adaptation to any revisions of WCAG standards that may occur in the future.

Relation between WCAG regulation and banking

The core objective of WCAG 2.1 compliance is ensuring that all digital banking services are accessible to various individuals, including those with disabilities. Many people rely on assistive technologies such as screen readers, voice commands, and keyboard navigation to interact with digital services. By adopting WCAG 2.1 standards, banks can provide a seamless experience for visually impaired users, those with motor or hearing disabilities, and individuals with cognitive limitations.

These regulations directly impact the banking sector and extend to online banking platforms, mobile apps, ATMs, and customer service portals. Easy usage of such financial services is essential to everyday life, and ensuring digital accessibility guarantees that every client can manage their funds independently. After June 2025, failure to comply with WCAG 2.1 standards can result in legal consequences, reputational damage, and the loss of users who require accessible services.

Adapting banking services for WCAG 2.1 compliance

To comply with WCAG 2.1 regulations, banks must take proactive measures and implement meaningful adjustments. Spyrosoft, in this regard, offers comprehensive solutions and compliance expertise tailored to the banking and financial services sector. We leverage our vast technological know-how and domain knowledge to ensure:

- WCAG 2.1 guidelines implementation: Meeting WCAG 2.1 Level AA standards ensures that websites, mobile apps, and digital banking platforms remain accessible to all users, including those with disabilities. By making targeted adjustments, digital services become more inclusive, legally compliant, and easier to navigate, enhancing customer satisfaction and reducing the risk of costly legal challenges.

- Inclusive design and development: Designing and developing digital banking platforms with accessibility in mind ensures seamless user experiences for all customers. Code compatibility, responsive layouts, proper contrast ratios, scalable text options, structured information architecture, and alternative text for images create a more intuitive and usable interface. An inclusive approach not only improves client engagement but also strengthens your brand’s reputation and allows you to reach a wider audience.

- Testing with accessibility experts: Testing digital platforms with accessibility experts and individuals who rely on assistive technologies reveals usability challenges that might otherwise be missed. Gathering and using such feedback ensures that digital banking services work seamlessly for all customers, minimising user frustrations and improving usability and trust.

- Monitoring and audits: Regular assessments identify accessibility gaps before they impact customers and cause friction. Audits uncover usability barriers, providing actionable insights that keep digital banking platforms compliant, up to date, and aligned with best practices. Proactive monitoring prevents costly corrections and ensures long-term accessibility.

- Accessibility training for teams: Equipping developers, designers, and content creators with accessibility knowledge ensures that digital banking platforms remain inclusive and aligned with EAA norms. Educating your teams about WCAG standards and best practices empowers them to integrate accessibility into their workflows, reducing the need for costly fixes in the future.

Make WCAG 2.1 compliance a priority

The EAA and WCAG 2.1 set new standards for digital accessibility in the banking sector. By embracing these guidelines, financial institutions not only meet regulatory requirements but also enhance user experiences and customer satisfaction, improve brand reputation, and reach a wider audience. With this year’s deadline approaching, you must act now to integrate accessibility into your digital product strategies and avoid unwanted legal challenges.

If you need help navigating the intricacies of WCAG 2.1 compliance, contact us via the form below, and see for yourself how we can secure a seamless and inclusive banking experience for all your users.

FAQ: EAA and WCAG 2.1 compliance

WCAG 2.1 (Web Content Accessibility Guidelines) is a set of international standards developed by W3C to make digital content accessible to people with disabilities. It guarantees websites, platforms, applications, and digital services are inclusive and functional for users with visual, hearing, or motor disabilities and cognitive limitations.

The EAA is a legislative directive introduced by the EU to ensure that key digital services and products are accessible to all users. Banking services fall under this directive, meaning financial institutions must align their digital platforms with EAA and WCAG 2.1 standards to avoid non-compliance penalties.

The European Accessibility Act (EAA), incorporating WCAG 2.1, becomes fully enforceable on 28 June 2025. From this date, businesses in sectors like banking, ecommerce, and telecom must comply, or face penalties.

WCAG 2.1 is based on four basic principles: perceivable, operable, understandable, and robust. Perceivable means that platforms must be accessible regardless of the sensory channels used. Operable ensures that users can seamlessly navigate and interact with the platform, including through keyboards or assistive technologies. Understandable indicates that content and UIs should be plain, clear, predictable, and easy to use. Robust refers to providing compatibility with various assistive technologies and their updates.

The new regulations directly affect the banking sector. Therefore, financial institutions must ensure that online banking services, mobile apps, ATMs, and customer portals are accessible to all users, including people with disabilities. Compliance is mandatory as of June 2025. Aligning with WCAG 2.1 will help banks avoid legal risks, improve customer service, and increase inclusion for a wider audience.

About the author

Contact us