Mortgage digitalisation: strategic tips to remain competitive

As technological advances continue to reshape traditional practices and offer unprecedented innovations in the financial sector, the demand for digitalisation in mortgage lending is increasing. The McKinsey report highlights that over 60% of European customers, particularly in Poland and the UK, prefer a digital mortgage journey. This trend holds immense potential, streamlining processes, increasing accessibility, and driving positive impact across the mortgage market.

This article explores the potential of mortgage digitalisation and looks at the positive changes it can bring for both consumers and financial institutions.

The only one way to go for bankers and their clients

The beginning of mortgage journey holds great promise and opportunity. Past experiences may have created challenges, but they have also paved the way for improvements. In the pre-pandemic times, navigating the mortgage process often seemed like a daunting task for customers. However, these experiences have led to advances that have made the journey more efficient. Despite its historical complexity, the back-office mortgage lending process is evolving to become more streamlined and less prone to error. With each improvement, the potential for a smooth and expedited experience increases, ensuring that even the smallest details are processed to prevent delays.

Recently, banks have started to add some incremental innovations such as OCR and automation. Over the next 2-3 years, there is expected to be an obvious trend towards increased digitalisation in mortgage lending. The pace of this transformation is expected to vary, influenced by regional differences and compliance requirements that can either hinder or facilitate the transition. However, there is only one direction to move forward – Digitalise it!

Do you need help with digitalisation?

Let's talkWhy is the digitalisation of mortgages such a great bet?

Users expect digital mortgages and there is no going back. Digital solutions are essential for meeting customer expectations in the mortgage industry. Can you imagine Gen Z clients patiently filling out paper loan applications and queuing up in a bank if the competition offers digital? Most users expect digitalisation of services and excellent UX, the last banks to digitalise will miss out on the key market.

The digitalisation process itself has many advantages. These include:

Customer journey length – up to 4 times shorter

Forbes and Freddie Mac’s report hinted that the average time to close mortgage real estate deals in the US is around 40 days. At the same time, United Wholesale Mortgage (UMI), considered to be one of the leaders in digitalisation, assured customers that their average has dropped to around 16 days, and they are hoping to reduce this to 10 days .

It doesn’t take a customer experience specialist to understand the benefits of a process that is 3-4 times shorter for anyone trying to get a new home.

Managing loan origination costs fall just as climate compliance adds more complexity to the process

The exact scale of savings is impossible to predict as costs vary between markets and organisations, but we have some benchmarks and research to anchor expectations.

In a Forbes survey, just over half (55%) of small and medium sized banks expected to reduce mortgage origination costs by more than 25% by 2023 with process digitalisation. US credit union executives surveyed appear to be slightly less optimistic, with 47% of them sharing similar optimism.

Another aspect of digitalisation enablers is the support sustainability goals. A good example is Nationale Netherlanden, a company that originates billions of new mortgages (8.7 billion in 2022) and is aiming high with its sustainable development goals. This means processing additional data in the loan origination process to track the climate impact of the property. With little or no digitalisation, the cost of estimating climate risk exposure can be high.

Quality of the data

Anyone who has experienced document management processes knows the pain of poor data quality. OCR (optical character recognition) mistakes, typos, human error, inconsistencies – you name it. With the AI revolution just around the corner, expect even higher standards. The latest AI engines can fail if the input data is corrupt. Additional manual data processes add cost and time and are also far from perfect. The digitalisation of mortgages is bound to improve this.

Innovating with data integration

Looking ahead – we should expect greater availability of APIs and open finance will improve the loan origination processes. This is one of Accenture’s top trends for the mortgage industry. Loan origination system (LOS) vendors are adopting open application programming interfaces, making it easier to customise, extend and improve workflows. This increases the need for IT teams to tailor integrations to the needs of the business. Humans will not be completely replaced, but bots will support data processes by analysing for inconsistencies, patterns and areas of risk.

How to deal with the mortgage process digitalisation?

Hints from market practicians:

Firstly, prioritise existing clients—this makes things easier on both sides. The banks’ data and CRMs enable a deep understanding of clients, allowing for proactive outreach before they start searching for loan providers. Reaching out to clients with an easy and transparent digital process will boost trust and satisfaction.

Secondly, transform by creating building blocks and envisioning their future use cases. The Cash Loan process we built up was made of smart “Lego bricks”—some of it can be reused for mortgage flows.

Finally, make sure your Agile teams adjust to the internal need for high-level timelines.

Szymon Kosnik, Head of Retail Risk at Santander Bank Poland

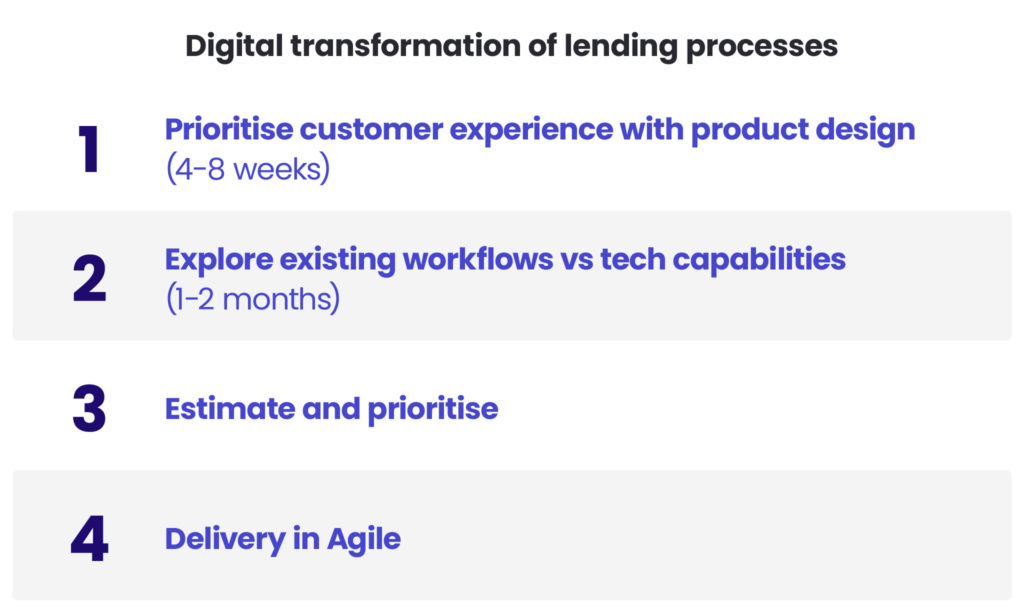

At Spyrosoft, we have divided the digital transformation of all our lending workflows into 4 stages. This also applies to mortgages, although these loan origination journeys see more external limitation for full digital.

Prioritise customer experience with product design (4-8 weeks)

Use user expectations as the North Star of the transformation. Map user journeys for key user personas. I recommend doing this from two perspectives – “as is” and “to be” (in the perspective of 2-3 years time). This activity allows companies to visualise the expected impact of change, metrics to be improved, the “Lego bricks of the process” and stakeholders to include in the transformation plan.

Explore existing workflows vs tech capabilities (1-2 months)

A critical stage of every transformation. Knowing what your North Star is, you need to be able to understand what it will take to move in that direction. Methods such as Discovery Sprints are an agile and effective way to determine what it will take to achieve most of your aims. Don’t expect to have all the questions and details planned here, this is not what agile is about. In the meantime, your IT team or external IT consultancy should advise you on solution architecture, short- and long-term wins, and a milestone timeline. If your tech partners have an innovator’s mindset, you can expect them to advise you on how to align the transformation with AI strategies.

Estimate and prioritise

The scope of the project will depend on your appetite for change and the starting point (in terms of workflow and technology). Expect an evolutionary process but address your stakeholders’ appetite for some early on. The final decision, as for the technology partner helping you in the transformation, should always be based on cost, quality and trust.

Delivery in Agile

As Spyrosoft, we like agile. This is the preference of most tech teams. Synchronising the agile manifesto with banks’ necessity of timelines is one of the areas where delivery needs to be particularly aware. We aim to ensure this with the seniority and experience of our team leaders, in particular the PM responsible for communication and identifying challenges early on.

Discover how we helped develop a debt management solution for Santander’s bank customers

At Spyrosoft, we started a joint project with one of the largest Polish retail banks – Santander – to develop an innovative solution for customer debt restructuring. The aim of the project was to improve debt management processes by providing users with an online self-service platform.

We created a user-friendly platform that integrates seamlessly with the bank’s existing systems. Key features include automated or semi-automated debt restructuring processes, alternative payment methods such as a different account or card, through an integrated payment provider, and active form that helps the bank’s representatives handle requests, as the form collects data at an early stage of the process.

It is worth noting that the solution we proposed has significantly reduced the debt restructuring process – around a quarter of decisions are made online and the entire process has been reduced from around 2 weeks and 2 branch visits to 7 minutes.

User feedback has been overwhelmingly positive, with the solution receiving a high rating of 4.5 stars in the bank’s feedback survey, highlighting its effectiveness in improving the customer experience and operational efficiency.

If you would like to know more about what the development process looked like, read our full case study.

Mortgage digitalisation – a long story short

With a growing share of digitally native customers and sustainability goals creating more data integration requirements, the transformation of all lending journeys is a must.

If you’re a bank in Central or Northern Europe or a Credit institution in US, the competition is already setting the bar high. It’s only a matter of a few years before everyone, from fintechs to small banks and credit unions, will need to be on the same page with digital mortgage journeys. Being an early adopter can monetise a premium form a competitive advantage. Being behind doesn’t avoid the need for transformation, it just means paying an additional price for not meeting the soon-to-be market standards.

Don’t hesitate to contact us and we will help you create a step-by-step plan for the digital transformation of your lending flows!

About the author

Our blog

Recommended articles

Contact us