Ecosystem development for TakTo

Technologies

- AWS

- AWS S3

- AWS Lambda

- Java

- Angular

- React

- .NET

- TeamCity

- Terraform

- Slack

- Jira

Business needs

The Takto’s main priority was to update the way they’ve been communicating with their customers and how they manage their database. Throughout the development process, the implemented cloud-based solutions needed to be corresponded to what is currently available on the market and scaled at any times. In addition to optimizing existing communication channels, TakTo has set the goal of creating an innovative customer interaction mobile version oof platform to reach a wider group of target consumers.

Solution description

Before we can start the implementation, we developed a detailed plan covering all necessary stages of the process. The solution we provided to the client consists of 3 main components:

- TakToEasy chatbot,

- Customer dashboard,

- Migration of data and applications to the AWS cloud.

The TakToEasy chatbot is a compounded customer service tool that can respond to inquiries even if none of the customer support representatives is available. It’s integrated with many partner platforms and effortlessly combines with external websites. Customers can use the app to check their credit rating and take a loan within a few minutes. The tool was designed to be intuitive and easy to use. This new sales channel increased the number of loan applications by 3000 per month.

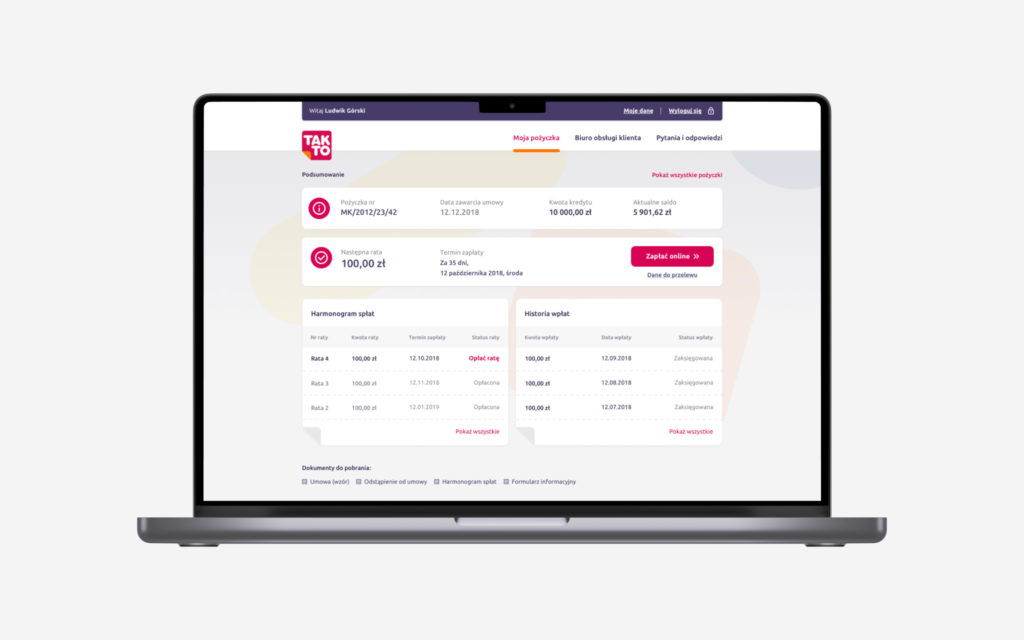

Regarding the customer dashboard, the team at Spyrosoft was responsible for the comprehensive delivery of the project – starting with support in designing the product concept and the MVP that would fit TakTo’s business needs to the development, implementation, and maintenance. The customer dashboard goes more than well with TakTo’s app ecosystem, serving as a touchpoint for communicating with the customers and allowing them to apply for loans directly and manage their obligations online. Before that, both processes were only available with support from the call centre employees.

The third project we developed for TakTo was the data migration to AWS virtual servers. We designed the application’s new architecture and planned how the data would be transferred to the new locations.

The entire process was completed gradually, starting with non-customer-facing functionalities that wouldn’t interfere with the customer support work. The architecture of the application was cloud-based entirely, and the components were introduced one by one using non-production environments and were tested thoroughly.

Our responsibility

We were responsible for project implementation and cycle management, incorporating a campaign builder into the chat for manual configuration of sales campaigns. The development involved both front-end and back-end engineers. The usability of the solution for operators and customers was ensured by our UX/UI designer. Extensive testing, including both automated and manual processes at each stage of development, was carried out by our QA specialists. To ensure user safety, we commissioned an external security audit to verify compliance with all applicable standards and regulations.

Over time, Takto also decided to optimise the costs of the company’s cloud infrastructure, as the initial monthly expenses were too high and reached as much as $18,000, so we started our work with a thorough analysis of the existing situation because we wanted the solution to last for several years as the company’s business needs evolved. During the workshop, we identified areas for improvement and worked with the client on a cost-cutting approach that would achieve the desired results without compromising the quality of products and services. After implementing the developed strategy, the reduction in cloud infrastructure costs reached 68%, significantly exceeding the project goal.

As the Spyrosoft team, we are currently responsible for maintaining and supporting the customer dashboard so that customers have constant access to their data.

Results of collaboration

The solution we provided helps TakTo attract more customers, deliver customer service, recommend products, and drive sales. It allows them to configure sales campaigns, identify customers and assist with credit checks. If your organisation is looking for a similar solution, contact us today – our financial services experts will be happy to explore and address your specific requirements.

Case Studies

Read other success stories of our clients

Contact