Why manual commodity trading is costing you more than you think

In the volatile world of commodity trading, timing is everything. Prices shift in seconds, margins vanish in moments, and the difference between profit and loss often comes down to how quickly your team can respond to changes. Yet across the industry, many trading firms still rely on outdated and fragmented systems.

Commodity trading moves fast. Can you keep up?

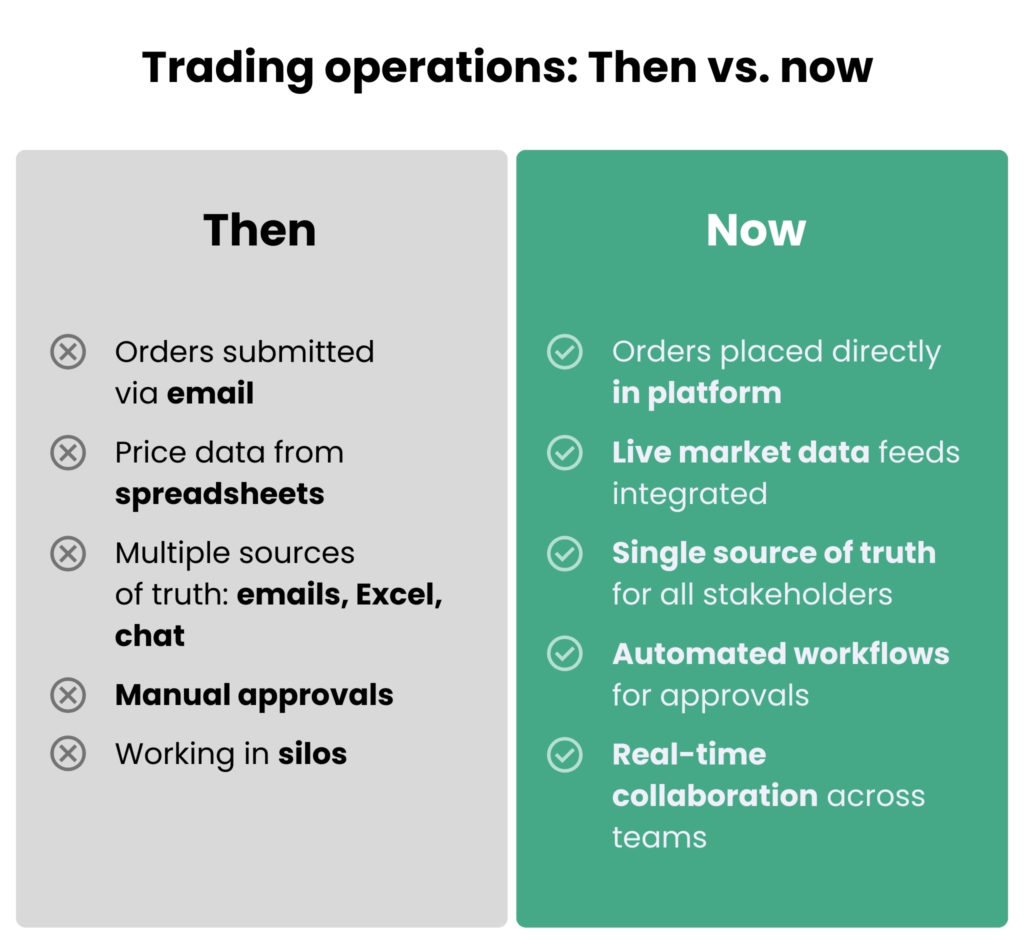

Day-to-day operations depend on Excel spreadsheets, scattered email threads, manual data entries, and systems that are not designed to communicate with each other – let alone keep up with the pace of global markets.

This kind of setup might have worked a decade ago. Today, it’s both inefficient and expensive. And while traders struggle to keep pace, competitors who have embraced automation are already executing trades faster, scaling smarter, and maximising their margins.

So the question is no longer whether legacy processes are holding you back – it’s how much they’re costing you every single day.

The high cost of unstructured operations

Speed, precision, and seamless coordination – in commodity and currency trading, these are non-negotiables. Every order, every data point, and every decision must flow seamlessly between trading desks, operations teams, and executive leadership.

Unfortunately, too many firms are still operating in a system where key processes are designed for a slower world, struggling to keep up with the demands of today’s markets.

Here’s what that looks like in practice:

- Orders are tracked using Excel.

- Emails serve as the primary communication channel for status updates.

- Manual data re-entry is the only way to transfer information from one system to another.

- And if something changes? It’s another round of revisions, approvals, and back-and-forth communication.

Each of these steps introduces delay, and each one opens the door to error.

Every delay has a price tag

In this kind of environment, even the smallest setback can lead to significant consequences. Manual data entry creates room for mistakes. Disjointed systems mean traders and operations teams are often working from slightly different versions of the truth – causing confusion and miscommunication.

What’s more, without a centralised platform to manage order changes and approvals, even minor modifications can become points of friction.

The consequences stack up quickly: missed trades, rework, or bottlenecks that stop deals before they even start. All of it comes at the expense of what matters most: profitability, transparency, and the ability to respond to the market dynamics in the moment – not after the fact.

At the root of the problem is a divide between the trading workflow itself: between the teams executing trades and those responsible for supporting or approving them.

In theory, it’s a single and seamless process. In practice, disconnected tools and non-standardised processes often leave these groups operating in silos.

As a result, traders end up working with outdated data and waste time chasing down the status of orders instead of executing them. Meanwhile, operations teams struggle to keep pace with market changes – losing track of what’s been approved, and by whom. Additionally, leadership lacks the real-time visibility needed to make confident decisions quickly.

In a trading environment where human decision-making still plays a central role, this lack of structure is not only outdated, but also dangerous.

Consequences: When efficiency and profitability drift apart

In trading, speed determines the difference between seizing an opportunity and incurring a loss. The time between making a decision and executing it is often measured in seconds. However, when your systems can’t keep up with the pace of the market, that gap grows wider really fast.

Timing is everything

Slow order processing surely is not just an inconvenience; it also poses a direct threat to profitability. In fast-paced markets, a five-minute delay in execution can mean the difference between purchasing at the best price and overpaying by thousands. The longer the delay, the higher the financial risk. Every moment of hesitation hands advantage to your faster competitors.

No visibility means no control

Without real-time tracking and change management tools, traders and operations teams are forced to operate reactively. There’s no simple way to monitor the status of an order, approve changes, or trace its execution history. When things go wrong (and eventually they do) auditability becomes a nightmare, and trust in internal processes diminishes.

Inflexible systems struggle under pressure

Legacy tools can’t handle the intensity of modern trading. They fail to adapt when volumes spike or scale when complexity increases. Manual workflows can’t adapt fast enough, resulting in backlogs, missed windows of opportunity, and increased errors. This not only impacts profit margins but also introduces reputational risk, especially in client- or broker-facing interactions.

Scenario: A moment lost, a deal gone

Imagine a trader spotting a sudden swing in the currency markets. The opportunity is clear: they need to execute a high-value order immediately. But instead of acting swiftly, they’re copying data from an email into Excel, manually updating quantities, and checking against a spreadsheet for pricing.

By the time the trader submits the order (via email or an outdated interface) the price has already shifted. The opportunity is gone. In fact, in many cases, the trade is never placed – not because the trader missed the signal, but because the data they relied on was outdated. What could have been a profitable and timely execution turns into another lost profit (and mounting frustration).

Moral of the story? The market doesn’t wait for systems to catch up, and neither should you.

A smarter system, designed for commodity traders

Today’s traders face a paradox: they’re expected to move fast, act strategically, and respond to shifting market signals – all while being buried in manual tasks and legacy systems.

Instead of making quick, informed decisions, they chase down information. This limits their ability to think ahead. And let’s be honest: every moment spent fixing broken workflows is a moment not spent seizing market advantages.

With the right tools in place, traders can stop reacting to operations and start focusing on market signals. Automation, transparency, and real-time data access empower them to make smarter, faster decisions – and spend their time where it truly counts.

That’s exactly what we delivered in a recent project for a global commodity trading company. Their teams were struggling with disconnected tools and time-consuming manual processes. Traders were constantly context-switching and losing margin in the process. Our solution helped them transform their approach – integrating their operational workflows with a high-performance execution layer.

The result? Less noise and more clarity. The system connects data, automates approvals, and provides critical order insights instantly.

This frees up time and mental space for traders to focus on what they do best: maximising value through smart, timely trades.

Automation = competitive advantage in commodity trading

Modern trading operations require more than just surface-level digitisation. They need systems that “think” and tools that actively detect, flag, and respond to changes as they happen. That’s the kind of intelligent automation we built into our solution.

Our solution eliminates slow, manual touchpoints that consume time and introduce risk. It automates the most critical points of friction in the trading process:

- Order modifications? It instantly detects them and triggers smart, predefined approval workflows for approvals or rejections.

- Data accuracy? It’s automatically verified, minimising the risk of costly mistakes.

- Back-and-forth emails? It removes them and replaces them with straight-through processing and full transparency across teams.

Proven impact: From minutes to moments

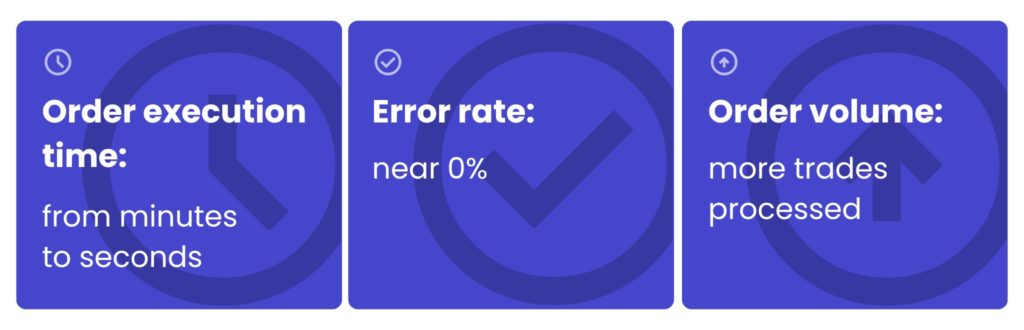

In practice, this translates to major gains. Our client reduced their average order execution time from 5-6 minutes to under a minute. It’s a shift that enabled faster market response, more accurate pricing, and greater operational throughput.

When execution moves faster, so does everything else: decisions, settlements, reporting, and ultimately, profitability.

What it means for your business

The value of a modern, integrated trading solution goes far beyond speed. It reshapes how your entire organisation thinks and operates – from the front office to the back office. Let’s recap the benefits:

1. Faster execution = better market timing

First, in commodity and currency trading, your ability to respond to market shifts in real time defines your competitive edge. When your systems eliminate manual steps and reduce execution time, you can act faster and with greater confidence. That means buying and selling at the optimal moment, not a minute too late.

2. Increased throughput, fewer errors

Next, automated workflows allow your team to process more orders without increasing headcount, and without sacrificing accuracy. By minimising human input, the system reduces the risk of miscommunication, incorrect pricing, or duplicate submissions. As a result, every trade becomes cleaner, quicker, and easier to audit.

3. One source of truth across the business

Finally, when data, approvals, and workflows are unified in a single platform, organisational silos disappear. Traders gain immediate access to the information they need. Operations teams can track progress and identify issues in real time. Finance and compliance gain full visibility and traceability. Everyone’s working from the same playbook, which means fewer surprises and better results.

Conclusion: Outdated systems are a risk you can’t afford

To sum up, in today’s fast-moving markets, sticking with outdated tools and manual processes is inefficient and risky. Every delay, missed opportunity, and human error erodes your margins and threatens your hard-earned reputation.

The companies that thrive are the ones that connect operations with trading, eliminate unnecessary friction, and empower their teams to act decisively and clearly.

Technology is no longer a “nice to have.” It’s the foundation of competitive trading, enabling real-time execution, data-driven decision-making, and full transparency across all functions.

It’s time to modernise your trading operations with a solution designed for real-time markets and real business impact. Discover how a custom-built platform, proven in live commodity trading environments, can streamline your workflows. Check our Commodity Link in detail.

FAQ

In fast-moving commodity trading markets, speed and accuracy are essential. Automation reduces delays in executing trades, ensures real-time visibility, and removes manual errors from processes. Whether trading energy commodities, precious metals, or agricultural goods, an integrated trading platform helps investors and companies buy or sell at the optimal time, improving profitability and risk control.

Commodity prices are influenced by supply and demand imbalances, production costs, geopolitical tensions, currency fluctuations, and even seasonal trends. For example, energy commodities like crude oil and natural gas are highly sensitive to global demand forecasts, while agricultural commodities are influenced by harvest yields and climate conditions.

A futures contract is an agreement to buy or sell a specific quantity of an underlying commodity at a predetermined price on a set date in the future. Futures trading allows investors to speculate on price movements or hedge against risk. These contracts are standardised and traded on regulated futures markets.

To start trading commodity futures, you need to:

Open an account with a broker that offers access to futures markets

Understand the contract specifications for your chosen commodity

Use a trading platform that provides real-time data and risk management tools

Learn how to manage margin requirements and exposure to the commodity.

Beginners often start with a small position or use commodity ETFs before moving into full-scale futures trading.

Investors can gain exposure to the commodity market without storing physical commodities by using: commodity ETFs (exchange-traded funds), commodity futures (futures and options contracts), exchange-traded commodities (ETCs). These tools allow you to buy or sell based on the commodity price while avoiding storage and transportation costs.

About the author

Contact us