Automated debt collection: leveraging advanced technology for success

The debt collection industry is undergoing a transformation, driven by the need for greater efficiency, accuracy and compliance. Traditional methods, often based on manual processes and outdated systems, are no longer sufficient to meet the demands of modern debt collection. The pressure to reduce costs, improve recovery rates and maintain regulatory compliance has led many financial institutions and debt collectors to explore advanced technology solutions.

As per industry reports, the use of advanced technologies has increased debt recoveries by 65%. A Gartner study also suggests that call centres globally can save as much as 80 billion dollars in revenue by 2026.

In this article, we will explore the key technology solutions for automating debt collection and how they can be effectively deployed to improve operational efficiency, optimise recovery strategies and ensure compliance.

Key technologies driving debt collection automation

As debt collection evolves, several advanced technologies have emerged as game-changers in the industry. These advanced technologies streamline operations and increase the accuracy and effectiveness of debt collection efforts.

Artificial intelligence and machine learning (AI & ML)

Those technologies are changing the way debt collection works, introducing sophisticated tools that improve prediction, communication and decision-making. They enable debt collection agencies to operate with greater accuracy and efficiency, particularly by using predictive analytics to analyse large data sets and uncover patterns in debtor behaviour.

By understanding these patterns, agencies can anticipate payment delays or defaults and tailor their collection strategies to individual debtors, increasing the likelihood of successful recoveries. Artificial intelligence is revolutionising the way agencies interact with debtors through AI-powered communication channels, such as chatbots and virtual assistants. These tools can manage a significant proportion of debtor interactions, delivering timely, consistent and personalised communications without the need for human intervention, resulting in reduced workload for human agents and improved customer retention rates by providing debtors with the information they need quickly and efficiently.

In addition, AI and ML are critical in automating the decision-making process. By analysing a debtor’s financial situation and risk profile in real time, these technologies can speed up or even automate decisions regarding debt settlement offers, payment plans or escalation procedures. It ensures that decisions are data-driven, unbiased and aligned with business objectives.

Robotic process automation (RPA)

RPA is another key technology driving the automation of debt collection activities. It focuses on automating repetitive, rule-based tasks that are common in the debt collection process, freeing up human resources to focus on more complex, value-added activities.

For example, RPA can be used to automate the sending of payment reminders, the processing of payments and the generation of reports, all of which are essential but time-consuming tasks. By eliminating manual intervention in these processes, RPA increases operational efficiency, and reduces the risk of error, resulting in faster and more accurate debt collection.

One of the essential strengths of robotic process automation is its ability to integrate seamlessly with existing legacy systems. Many financial institutions and debt collectors operate on a patchwork of legacy systems, making a complete overhaul of their IT infrastructure both costly and disruptive. RPA tools can interact with these legacy systems, pulling and processing data as needed to keep operations running smoothly without the need for a complete system replacement.

Challenges facing the debt collection process

Escalating operational costs

The financial burden of managing the debt collection process can be significant and have a direct impact on the overall profitability of the business. These costs can include staff, technology, compliance and other overheads that, if not optimised, can erode margins and affect financial performance.

Securing debtor agreements

A significant challenge is the low rate of debtor compliance, reflecting the difficulty in convincing debtors to commit to repayment plans. This may be due to inadequate communication strategies, insufficient incentives, a lack of confidence in the process, or poor customer relationships.

Profitability under pressure

High operating costs combined with sub-optimal collection success rates can have a significant impact on profitability. Inefficiencies in the collection process can lead to a mismatch between expenses and revenues, making it difficult to maintain financial viability.

Difficulties in contacting debtors

Reaching debtors remains a critical challenge, often due to outdated contact information, unresponsive debtors, or legal and regulatory restrictions. This barrier can delay or derail collection efforts, resulting in longer recovery times and reduced effectiveness.

Fragmented data management

Storing debtor information in multiple systems can lead to disorganised data management, creating inefficiencies in accessing, updating and using critical information. This fragmentation can hinder the decision-making process and lead to missed opportunities for timely and effective collections.

Lack of automation and process optimisation

Relying on manual processes for routine debt collection tasks increases the risk of errors and inefficiencies. A lack of workflow automation can slow down operations, reduce accuracy, and ultimately decrease the overall effectiveness of the debt collection process. Incorporating automation can streamline operations, reduce costs and improve consistency of results.

As experts in the financial sector, we understand the challenges our customers in the debt management sector struggle with. Our answer is to adjust your current solution to a digital, customer self-service era, using cutting-edge technologies, which will increase your debt collection rate.

Michal Kaleta, Director of Financial Services

How can AI-powered automation help debt collection companies

Increased efficiency for collection agents

Integrating AI automation into collections streamlines repetitive tasks such as data management and documentation, allowing agents to spend more time on high-impact activities such as negotiation and conflict resolution. By automating manual processes, artificial intelligence reduces the time and resources required to manage collections, leading to greater efficiency and productivity in operations.

Reduced costs

AI automation offers significant cost savings in debt collection by reducing the costs associated with staff, training and resource management. By minimising the need for human intervention and optimising workflows, AI enables collection agencies to strategically allocate resources and achieve significant savings. As a result, these cost reductions allow agencies to invest more in technology and innovation, increasing their overall profitability.

Advanced predictive analytics

AI algorithms use extensive historical data to anticipate debtor behaviour and predict future trends, enabling debt collectors to proactively target delinquent accounts. Through predictive analytics, AI increases the effectiveness of collection strategies, improves resource allocation and reduces the risk of non-compliance, which allows agencies to prevent defaults, minimise write-offs and ultimately maximise recovery rates.

Improved customer experience

With AI automation, debt collection agencies can provide personalised and compassionate customer interactions, increasing overall satisfaction and the chances of successful debt recovery. AI-based tools can analyse debtor behaviour and preferences to tailor communication methods, payment plans and negotiation strategies to individual needs, building trust, transparency and collaboration. This level of personalisation increases customer satisfaction, and fosters stronger, long-term relationships.

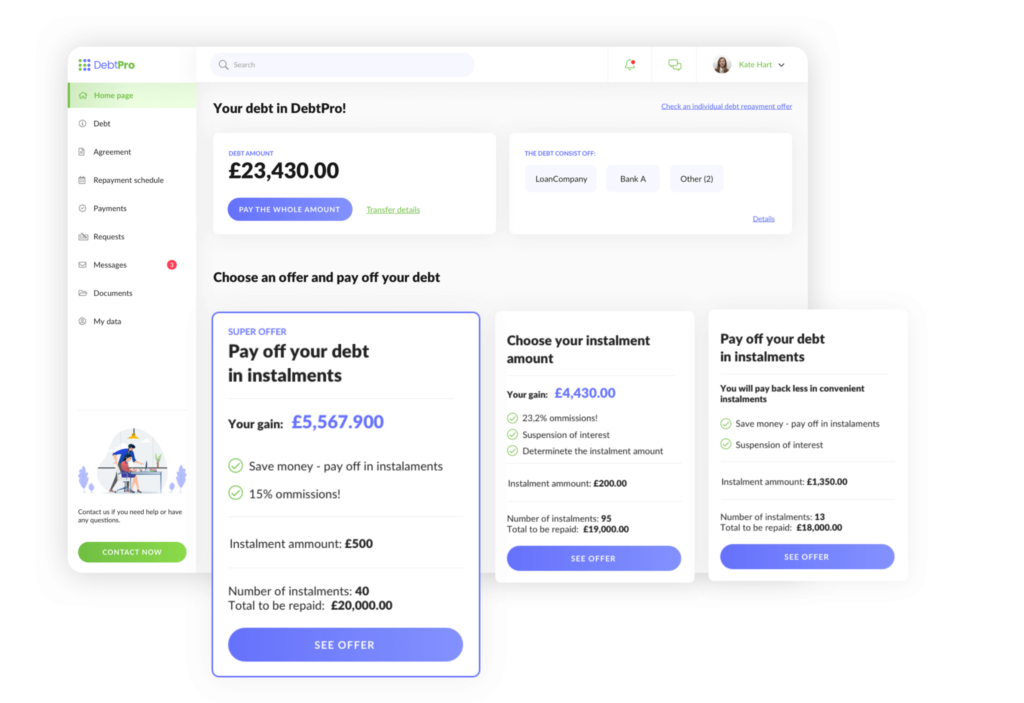

A unique automated solution for debt recovery

DebtPro is highly customisable debt management software designed to optimise and simplify debt collection processes. It integrates seamlessly with existing systems, providing advanced customer self-service options while reducing operational costs.

Our platform is fully customisable and can enhance current debt management systems or operate as a standalone solution. Key features include online payment management, electronic document signing and integrated communication tools, all accessible through an intuitive, user-friendly dashboard.

The software delivers significant benefits such as an approximately 10% increase in contract signatures, reduced operational costs and easy online document access almost immediately after its full implementation. It is suitable for both B2C and B2B applications and operates independently of open banking services, ensuring it can be tailored to meet the unique needs of any business.

Make Debt Management more efficient!

Get a free demoOver to you

An automated debt collection process allows you to focus on the core of your business and maximise the effectiveness of your processes.

You can leverage the full potential of data to benefit you and your customers. Industry leaders rely on well-implemented automation for its reliability and effectiveness. The bottom line is smoother cash flow, increased profits, reduced expenses and satisfied customers.

If you want to see how debt management and collection software works in practice, get in touch with our expert today and take a look at our fully adjustable platform!

About the author

contact us

Contact me to discuss how we can help you

Recommended articles