Ecommerce industry hints – how to prepare for the challenges ahead

The uncertainties caused by a pandemic, rapidly rising inflation, and the war in Ukraine have a massive impact on many businesses. For the ecommerce market, all that can be particularly challenging, given the significant change in customer behaviour and reluctance to spend.

So, how should the ecommerce industry prepare for all this?

Spyrosoft eCommerce CEO Cezary Kozon answers this and other questions in an interview conducted on the initiative of the ICAN Institute, originally published in ICAN Management Review.

How does the experience of a pandemic, followed by war and the current inflation, affect the ecommerce market in Poland? Has the sector slowed down? What is the prognosis for the upcoming months?

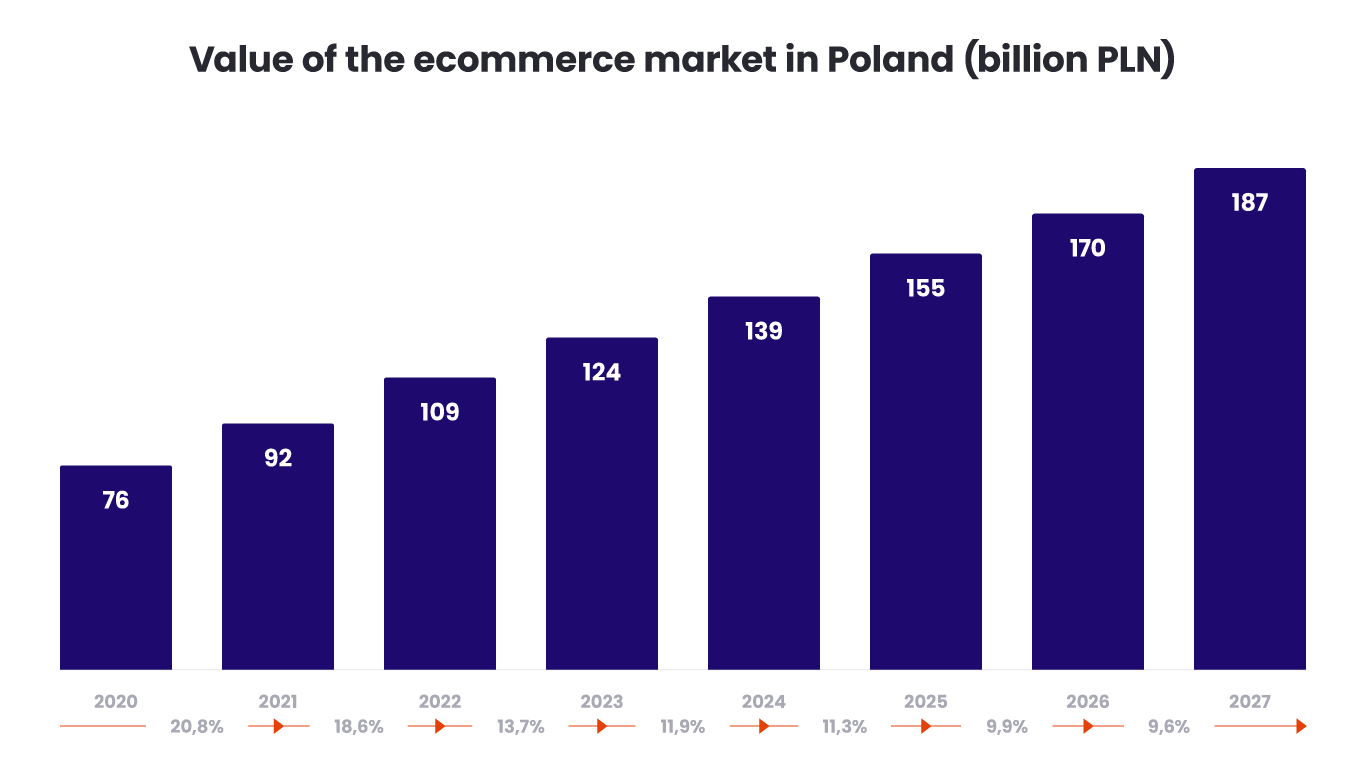

Cezary Kozon: The growth of ecommerce during the pandemic compensated for the losses in traditional sales, although even then, it was noticeable that online sales are not able to fully replace offline sales. The reasons are varied. Some people simply stopped buying things. Others showed a lack of trust and an inability to use an online store – they were used to the “standard” shopping mode, so they just waited for the return of traditional trade. Therefore, the future of the ecommerce industry could have developed in two ways. The first scenario assumed that the strong uptrend of the pandemic era would continue; the second, that we would return to the pre-pandemic uptrend: slower, but steady. At this point, due to the war, which strongly affects consumer sentiment, and the prices of fuel, which drives inflation even more, we do not know how this trend will look. Reports say that within 5 years, the ecommerce market in Poland will double and reach a value of PLN 160-170 billion. However, taking the crisis into account, this time horizon for reaching such a value may be postponed.

It is worth noting that the strong growth of the ecommerce industry during the pandemic caused many companies to start investing in innovative solutions – especially in the B2B segment.

Manufacturing companies, as well as wholesalers trading on a large scale, noticed that this is an area that they need to invest in – and a lot of investments have taken place. This, in turn, influenced companies specialising in creating digital solutions for the industry, the so-called ecommerce houses. The demand for their services was so high that they could actually choose their customers during the pandemic. And they chose those that brought the highest margins. As a result of the high demand for software house services, lack of processing capacity, but also a significant increase in programmers’ earnings, the prices rose. It is worth emphasising that these wages doubled in just three years, which is also one of the inflation-driving factors. The growth of the ecommerce industry has contributed to the fact that inflation is rising. Of course, at the end of the day, it is the customer who has to pay these costs.

Source: Development prospects for the ecommerce market in Poland 2018-2027

You say that it is the customer – who is now counting every penny – that has to pay the final cost of the inflation. So, how to maintain both sales and customer loyalty in a situation like this?

CK: The costs of running an ecommerce business have increased. But on the other hand, the declining spending power leads to a decline in sales, acquiring new clients begins to become more and more expensive – the costs of acquiring one client are twice as high as they used to be. This means that the store does not make money on the first transaction of a new customer – so we need them to come back. If the brand has not nurtured its loyal customer base so far, this is where it will encounter a serious problem. This will result in a structural problem that cannot be solved by investing in new customer acquisition through online marketing.

For retailers, a very important indicator is the fact that most of the consumers who experienced online purchases during the pandemic, have bought something online at least once after it has ended. Obviously, a very large percentage of them returned to traditional shopping, but this may be because consumers felt the need to leave their homes and experience something that has not been available for the past two years. It shows that the online must also “go offline”.

What does it mean that the online must “go offline”? What kind of actions are we talking about?

CK: We are talking about a number of activities, ranging from how the products are described on the e-shop’s website, how many photos of a given product there are, is it also presented in the form of a video, and whether the consumer has the opportunity to connect with a consultant, with whom they may discuss e.g., product specifications. The latter aspect is particularly important in the context of stores that offer specialist materials, dedicated, for example, to some sort of a hobby. In such cases, specialist knowledge is key. Currently, when buying online, we have contact with call-center employees who are not advisors or traders, so they are not able to advise the customer on which product to choose. This is the biggest gap between online sales and traditional stores, where the consumer gets this substantive knowledge and support. Thus, “going online” consists of providing contact with an expert, a specialist in a given field.

The activities you mention also generate costs, and we have already said that just being part of the ecommerce industry is very expensive. Thus, should we plan future investments in new solutions?

“When everyone is afraid, you have to be brave; if everyone is brave, you should be afraid.”

CK: Yes, customers will buy less and conversion rates will drop. It is true, and we need to be prepared for that. Nevertheless, people will continue to visit stores and browse through websites. This is extremely important – because what they see now consumers right now will remain in their memory. When the crisis is over, the consumers will already know the places they want to go back to. Therefore, taking care of the customer experience is even more important than before. Let us pay attention to the case of CCC, which did not have an online store for a very long time. What happened? They spent a very large amount of money on the E-obuwie platform because they realised that a lack of online presence is a big mistake nowadays – and they had to fix that mistake. Therefore, if we do not take these actions today, it is obvious that someone else will, and we will lose on it, or – as in the case of CCC – we will have to spend money on it anyway, and the costs will be much higher.

The Polish ecommerce market is divided between one main marketplace, i.e., Allegro, and other players. The native hegemon, having access to large funds and an army of developers, plans on implementing solutions such as connecting with a virtual advisor. Thus, it is going to introduce a certain standard to the market that consumers will expect from other players in the ecommerce industry. That’s why you have to be brave.

Let me give you another example. Companies that invested in ecommerce even before the pandemic had properly prepared scalable software – therefore, during lockdowns they were able to handle 10 times more orders than before. And such an approach is not obvious at all – the majority of companies, during implementation, often cut costs and implement a solution that is appropriate for “now”, and not necessarily prepared for the near future. When a sharp increase in demand occurs, it has significant negative consequences. And there were companies in Poland that would possibly have been able to record even higher revenues during the pandemic, but their software could not handle the amount of orders, simply because it was not prepared for it.

What are the most important investments that need to be made in the ecommerce industry today?

CK: We should invest in every solution that will make the customer buy something here and now, and that will make them come back in the future. In this context, we have to mention the omnichannel strategy, i.e., combining online and offline sales. Imagine a situation where I come to a clothing store and want to buy pants, but my size is missing. It is rare for the salesman to offer me to pay for this product now and have it delivered to me by a courier tomorrow. Why? On the one hand, it is a matter of targets. On the other hand, it is a faulty system that is not prepared for such a situation. Therefore, when the right size is not available at a traditional store, the customer is informed to order them online. And what does the customer do? They go to the store next door and buy the right size there. And even when they decide to buy them online, there are so many options available after they search for the product that they may very likely buy another brand anyway. We put all the responsibility for making the purchase on the customer – and that’s how we lose them.

Another process that doesn’t, but could definitely work offline, is deferred payments. After all, offering payment in instalments, also in traditional stores, is an obvious support for those customers who want to spend money with us, but do not have the full amount at the moment. Meanwhile, corporate systems are still not ready to meet their customers’ needs.

Ecommerce is still an isolated field, which results from investments and strategic decisions made five or ten years ago. In offline commerce in Poland, we still use ERP systems that were introduced 25 years ago, and which today are completely detached from reality. But each and every retail company of the future will have to be immersed in technology – we are way past the point of no return now. Therefore, if commerce companies will keep refusing to plan their future without keeping online presence and development in mind, they will simply lose in the global competition.

If you are interested in how Spyrosoft eCommerce experts can help your business, feel free to reach out to us or check our offering page.

About the author