How the pandemic shaped the future of ecommerce

In the last couple of years, the ecommerce market has experienced many changes, causing a real rollercoaster for companies in that sector. The ecommerce boom and increased use of online shops in the early stages of the pandemic was pleasing to the whole industry. However, the slowdown caused by the gradual return to pre-pandemic normality has made it difficult for some companies to meet previously set targets. Additionally, the uncertainty among customers caused by the war in Ukraine and constantly rising inflation is not helpful at all.

All of this may raise questions, including: how has the market changed? What is the new normal? And how can we deal with it? In this article, created in collaboration with Cezary Kożon – the CEO of Spyrosoft eCommerce, we aim to answer these questions.

Pandemic boom on digital economy

The first half of 2020 went down in the memories of many people as an uncertain time, and for certain businesses, it marked as a ground-breaking moment of change. Some of the biggest beneficiaries of this period have been the digital and ecommerce sectors, which have seen unprecedented growth.

The prosperity during this period was so great that, according to data from Adobe, the US market alone saw a 55% increase in online spending over the two years of the pandemic. This adds up to a total of around $1.7 trillion.

Such high figures were coined as a result of widespread lockdowns and requests to stay at home. As a consequence of all this, a significant proportion of shoppers gave up on non-essential purchases in physical shops, and some customers even started buying these kinds of products online with home delivery.

In the early days of the pandemic, the first instinct of both numerous customers and entire companies was to stock up and buy out large quantities of products that seemed indispensable, such as medical supplies, hygiene goods or everyday products and food with a long shelf life.

However, once people’s initial impulses were fulfilled and things began to calm down, folks who needed to spend more time at home began to focus on finding new hobbies, improving their homes and new domestic workplaces, or taking care of their physical health as much as they could in the at-home version.

As a result, in some sectors, there has been a significant increase in the ordering of certain products via the Internet. Online markets such as electronics and interior design boomed, while others like travelling fell hard, for obvious reasons. In some cases, the key factor of whether a sector was doing well or not, was the pre-pandemic state of its digital transformation and the ability to swiftly adapt to the new reality.

Electronics

One of booming sectors was electronics, which represented around 22% of all ecommerce sales. The necessity and opportunity to work and study remotely has led to a high demand for electronic devices. Many consumers felt the need to upgrade or augment home equipment used for work. The most popular devices were laptops, tablets, and smartphones, which had to be ordered online due to the lockdown of retail outlets.

A significant number of retailers and major technology manufacturers began to pay more attention to their ecommerce services, focusing on user experience and building customer trust to boost conversion. Conducting such activities together with strong product demand has resulted in a 2.56% drop in cart abandonment rate in the industry. From an average of 88.05% to 85.49%.

As an example, illustrating the robust growth in this sector, we can take Apple, which in 2020 doubled the value of its shares and saw a 20% increase in revenue from its online sales alone.

Grocery

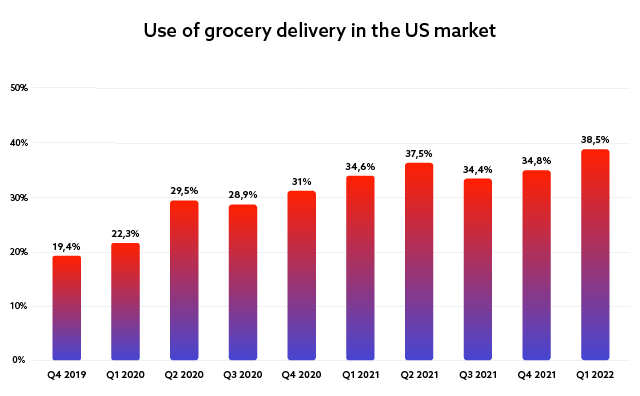

Another interesting sector was grocery shopping. Before 2020, the number of people ordering groceries online or via apps was small. However, an awareness of the dangers of pandemics, a reluctance to be in larger gatherings of people and the closure of restaurants led this type of shopping to become strongly popular. It is estimated that during the pandemic, online sales growth in this sector was doubled. A Cowen survey of 2,500 consumers showed that the United States has experienced significant growth in this sector, over the past few years. The growth between Q4 of 2019 and Q1 of 2022 was 19.1%.

Source: Charts: Ecommerce Penetration of Global Retail

Despite the pandemic, which seemed to have slowed down the way we live, saving time is still a key issue for many people. Therefore, offering fast delivery, whether by in-house service or with the help of external companies, such as Glovo or Getir, has helped to significantly increase revenue from online sales.

Fashion

An interesting sector strongly affected by the pandemic was also the online fashion market. An industry in which online shopping was already popular before the pandemic, slowed down sharply in the early stages of the lockdown, where most people spent time at home. Consumers were not buying new clothes, due to the lack of places they could go to in them. During this time, shops were seeing a lot of traffic on their websites and social media channels, but this was not translating into conversions.

However, with the gradual easing of restrictions, sales in this sector started to grow strongly, creating new trends and habits among customers. Casual, comfortable clothing became a trend among shoppers and as a result, it was companies with basics and sportswear collections that saw their share prices increase by around 7%.

The strong habit of using online fashion shopping and the consistently high demand for products means that this industry will continue to grow more and more. As market competition will also increase, it will be even more important for ecommerce services to differentiate themselves from others, e.g., by offering users new technological solutions such as AR, live shopping or image and voice search.

Besides the strong growth of some ecommerce sectors, it is worth mentioning that the demand for digital services has also increased during that period. This has arisen from the need for some Brick-and-Mortar shops, which have been sluggish in this regard, to move quickly to an ecommerce model, whether using a website or dedicated apps.

With the boom in the digital economy and online shopping, and with the need of moving away from retail therapy type behaviour during the pandemic, some might have wondered whether Brick-and-Mortar companies would survive this, and perhaps led some to even think that this was the moment when we would fully enter the future of ecommerce, where the world of shopping would settle for good in the online realm. However, as time went on, nothing of that sort happened.

Impact of the pandemic on the future of ecommerce and consumer habits

As pandemic restrictions began to loosen and shops and restaurants reopened, the ecommerce industry faced another change. Many customers returned to physical shops. It became apparent that the Brick-and-Mortar industry had not disappeared and that many customers still felt the need to buy things both physically and by themselves.

In addition, there are still sectors where consumers are far from choosing to buy online, such as car sales. Brick-and-Mortar therefore continues to be an important part of global retailing. However, it is worth bearing in mind that the pandemic has changed the behaviour and expectations of customers, who have become more trusting of online shopping and payments. All this adds up to a picture of a client who no longer has a problem between switching from one channel to the other.

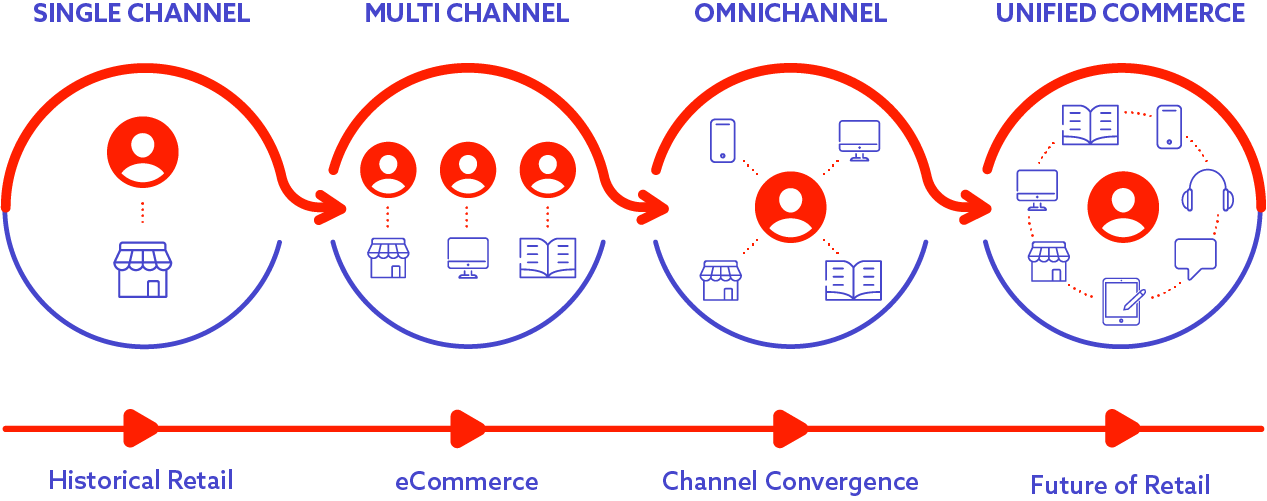

The fact that shoppers have a choice of both types of selling may contribute to the increased competitiveness between ecommerce shops and Brick-and-Mortar, or to the increasing combination of both experiences and the development of omnichannel and unified commerce strategies.

Significantly, the pandemic and post-pandemic time in many companies has strongly accelerated the process of digitising shops and their entire management. According to the McKinsey report, in numerous cases, this process has been rushed by 3-4 years. Of course, the best performing firms are still those that anticipate trends well and have a flexible approach to their business strategies. Therefore, the winners in terms of profitability during this changing time have been companies that quickly adjust and offered their users solutions to consumer trends, such as the PYMNTS-defined “Bring to me economy”.

In many sectors, there has been a great deal of development and implementation of both existing trends and those that have become apparent as a result of the pandemic. For instance, in the grocery sector, the personalisation of the shopping experience on websites and in apps, and the previously mentioned issues of fast delivery became hugely important. The fashion ecommerce sector, on the other hand, to provide its customers with the best possible shopping experience, has focused on the implementation and development of technological tools. All this to address matters such as the process of product search (Image and voice search) or the visualisation of how the user will look in a particular item (AR).

Unified commerce as the future of ecommerce

Given the new trends and changes in habits that have become apparent in the last couple of years, it can be easily concluded that a unified commerce strategy will be really important in the future of ecommerce. The unified commerce business model implies a focus on connecting the online shopping landscape with the real world of retail and on the unified management of all sales channels. It seeks to centralise the platforms in which the customer can interact with the shop, whether in the form of a physical store, a website, or a mobile app. The main advantage of such unification is that it enables the customer to quickly and seamlessly pick sales channels that meet specific needs at any given time. Here is what our ecommerce expert has to say about it:

“Unified commerce is a trend that fits perfectly with the statement ‘the new normal’. The pandemic caused online shopping to experience large growth, but as soon as the physical shops opened, a significant proportion of customers returned to them. And this made the industry wonder – why? What was the reason that customers started to buy less online? Analysing the data and all the trends, it was easy to see that consumers expect their online buying experience to be as real and as close as possible to the one in the traditional shop. But what is important, and what the name of the trend itself can tell you, is that this works both ways. This means that Brick-and-Mortar shops are also expected to become more and more online or digitised. All channels should work in tandem to draw on the greatest advantages of each, offering consumers the best possible shopping experience.”

Cezary Kożon, CEO of Spyrosoft eCommerce

Unified commerce is an extension of the well-known omnichannel strategy. But how do the two actually differ? The main difference is the approach to data management and exchange, which was limited in omnichannel. This strategy focused on a variety of different tools that were not interconnected and had limited communication capabilities.

Unified Commerce, as an upgraded version of the business model, addresses these limitations and enables the coordination of all channels and data within a single platform. Unifying and centralising all aspects of running a business helps to avoid many mistakes and errors, thereby streamlining all sales processes. Additionally, and crucially, this solution allows you to offer your customers greater flexibility, making it easier to increase customer satisfaction and loyalty.

If you are interested in introducing the latest strategies and technological solutions to your ecommerce business, contact us via the offering page.

About the author

RECOMMENDED READING: