Cloud solutions in fintech: how switching to AWS let TakTo stay more flexible

You should always try to move faster than your competitors when it comes to technology. One of the solutions that allows you to limit your spending and increase your capabilities and resources when needed, is cloud.

One of the industries where this technology is just emerging is financial services. Due to the recent influx of accessible and secure cloud solutions, the sector is growing rapidly.

This wasn’t the case pre-pandemic or even a few months ago.

So why have the financial services companies begun to turn to cloud solutions?

For years, the instability and underdevelopment of legacy services kept the financial industry stuck in its ways. The good ol’ pen and paper, as well as enormous mainframes and applications, underpinned the running of financial services businesses. The public cloud was thought not to be trusted in almost any case.

What made it worse was that financial executives weren’t the only group to mistrust the public cloud. Customers expected banking and financial services to be reliable and secure. They also justifiably expected all transactions and activities to happen in real-time, without any overheads or delays in approval. The technology was urgently needed, and all providers were racing to develop a feasible solution.

In addition to the barriers mentioned above, EU and US financial regulations were also major blockers for the industry to move on to cloud technologies. But it wasn’t only implied from the top. Some of the banks used the legal requirements as an excuse to avoid switching to more innovative services. The overall regulatory environment wasn’t ready for the digital transformation.

This landscape changed in 2016. It was particularly evident in the European markets, with the UK and Poland being good examples of countries where legislative changes happened early on. In the UK, The Financial Conduct Authority, which serves as a regulator for almost 60,00 financial companies, released a guide to using cloud services. The document clearly stated that these services are safe to be applied in banking if data hosting and security are ‘appropriately considered’. The revolution could begin.

But it wasn’t only this guide that pushed the financial industry to embrace cloud solutions. There were other factors as well, including the statements from the Information Commissioner’s Office and the Bank of England’s Prudential Regulation Authority. The regulators, as well as financial industry workers, finally understood that cloud solutions were already being used regularly in other areas where sensitive data handling is involved. Additionally, the technology and IT industry on the whole was becoming much more flexible when it came to managing risk assessment.

Once these documents were published, the word got out: innovation in the financial industry is not only possible, it is inevitable.

The technical solutions soon followed once the regulations had been adapted. One of the services that started being used widely in the financial sector for building secure IT infrastructure and systems was AWS (Amazon Web Services).

Fast forward to 2020 with its financial crisis, and cloud services are now needed more than ever.

Cloud solutions for the financial industry: Why and how did TakTo switch to AWS?

Let’s take a closer look at how we used AWS in the cloud migration project for one of our customers, TakTo using our status as the AWS Gold Partner.

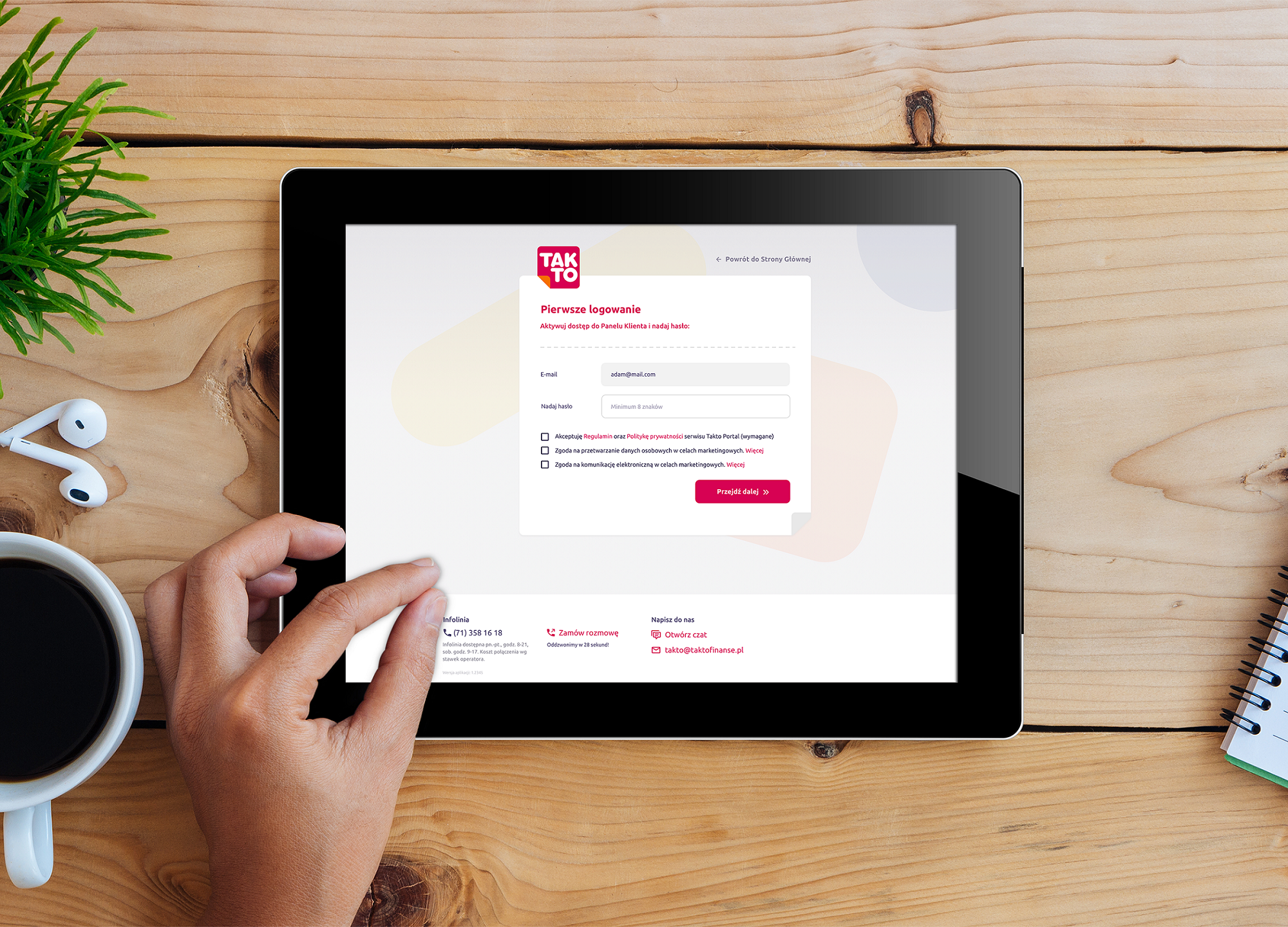

TakTo is a financial company located in Wroclaw, Poland. Using their services, the customers can take loans through an online chat and repay them in a dedicated customer platform. The company was established in 2012 and is following the ethical conduct principles as well as the Best Practices Guide issued by The Association of Financial Companies in Poland (ZPF).

For many years, TakTo has been using servers that needed to be maintained and scaled up at a physical location outside of their headquarters. As the company grew, this became troublesome and the team needed to be able to access the servers more easily. The physical space where they kept the servers was also costly and had to be kept in optimal condition. Technical staff was employed to take care of the machines. The outdated infrastructure needed near-constant investments.

Our team at Spyrosoft analysed the needs and available solutions and quickly concluded that designing and building state-of-the-art IT infrastructure would be the way to go.

What are the benefits of using cloud solutions?

Reliability

Virtual servers set up using the AWS services are famously reliable and fast. Amazon’s data centres are placed all around the world and once you upload your data to their servers, it is divided into a few secure locations. Therefore, it is not possible to lose all of your data if one component of one machine stops working.

Scalability

You can also scale up the number of virtual servers that are hosting your application or database when the number of your customers increases. The whole process can be automated, and even if it isn’t, it can be completed with just a few clicks. With physical machines, you’d have to buy and set them up before any expansion and development would be possible.

Security

AWS Infrastructure-as-a-Service solution also allows us to add automation scripts to almost every element of the architecture and track the changes following continuous development and continuous deployment practices. With AWS, we can also easily set up backup and disaster recovery procedures.

Flexibility & cost saving

Each AWS service is billed individually and per hour, so we can also turn on and off the virtual devices as needed and provide savings for our customer.

Virtual servers lets us save money because we can switch them on and off when necessary, or even add new instances within minutes. The solution is also highly flexible, which in turn allows our team to act faster and shorten the time to market for new services.

– Dagmara Majdak, Head of Project Development at TakTo

Customizability

There are almost no setup restrictions when it comes to customising the AWS services. When working for TakTo, we’ve been able to choose the operating system, database and programming language as well as other assets. Plus, the solution is famously user-friendly and intuitive, so our developers could focus on developing a setup for the customer instead of catching up.

How does the AWS migration process look like?

Let’s get back to TakTo’s case study. As straightforward as it sounds, the whole process required meticulous planning paired with detailed architecture considerations and continuous testing. Another level of complexity was added by the fact that TakTo is a 24/7 business, meaning that their customers had to be able to use the application without any interruptions, at all times. The change had to be completely invisible on the customer side as there are thousands of people visiting TakTo’s website each day.

Therefore, the migration was divided into a few different stages. We also took the ‘lift and shift’ approach where the whole process is completed with little to no changes. The process begins with transferring and testing smaller and non-customer-facing databases and environments. ‘We’d set up the virtual servers and the infrastructure, and we dive into the application.

Once all smaller and more reliable elements were transferred, we could start mocking them on production, and testing how the whole system works’, says Marcin Szremski, a DevOps specialist from the team of developers handling the migration.

The final stage of the process was focused around TakTo’s databases which were extensive and from the technical point of view, the trickiest element to move to Amazon’s virtual servers. All data had been preemptively secured through a series of backup transfers that would allow Spyrosoft’s team to access and upload them easily if any of the services would not operate as expected.

The final stage of the process was focused around TakTo’s databases which were extensive and from the technical point of view, the trickiest element to move to Amazon’s virtual servers. All data had been preemptively secured through a series of backup transfers that would allow Spyrosoft’s team to access and upload them easily if any of the services would not operate as expected.

This final stage of the infrastructure migration was completed over the course of an evening, with the whole team managing this highly orchestrated process in shifts. Each stage was assigned to a different developer, so once they received an ‘all clear’ from one person, they could then proceed with their part.

With the concluding migration secure, the team was happy to announce that the project was completed 3 weeks before the deadline. It was also invisible to TakTo’s end customers and its representatives, meaning that their activities weren’t affected by any of the processes.

As a result, TakTo has been able to stop using physical servers and can now add virtual machines if they need to. Being able to turn certain environments on and off, is also a huge advantage of AWS. ‘This lets us save money when we’re not using these environments. The solution is also highly flexible, which in turn allows our team to act faster and shorten the time to market for new services’ mentions Dagmara Majdak, the Head of Project Development at TakTo, during our conversation about the project. Mateusz Gralak who worked as a Project Manager from the Spyrosoft side, also adds that ‘By working with the AWS servers, we’ve been able to help TakTo get to the next level and join the leaders of the Polish financial market.’

Currently, the Spyrosoft team is handling the maintenance and making sure that the application is running smoothly. Some of these operations are also now monitored through the automated tools that were also introduced and applied when moving the services to the AWS machines.

What does the future hold for cloud solutions?

We’ll see more disruptive services and solutions in the financial industry in the upcoming years as the pressure from customers to stay in-sync and online at all times will grow even further, especially now that many companies are struggling to keep their resources and funding in place and in an urgent need of transforming their business as a response to the 2020 crisis.

At Spyrosoft, we’re ready to apply our approach and our experience to any cloud-related projects.

We’re really satisfied with how the migration projects are carried out and that’s definitely the direction we want to explore more going forward. We already have a list of customers who are asking for similar solutions to be implemented for their financial infrastructure.

– Sławomir Podolski, the Financial Services Business Unit director at Spyrosoft.

About the author